A Growing Controversy Around Banking Integrity

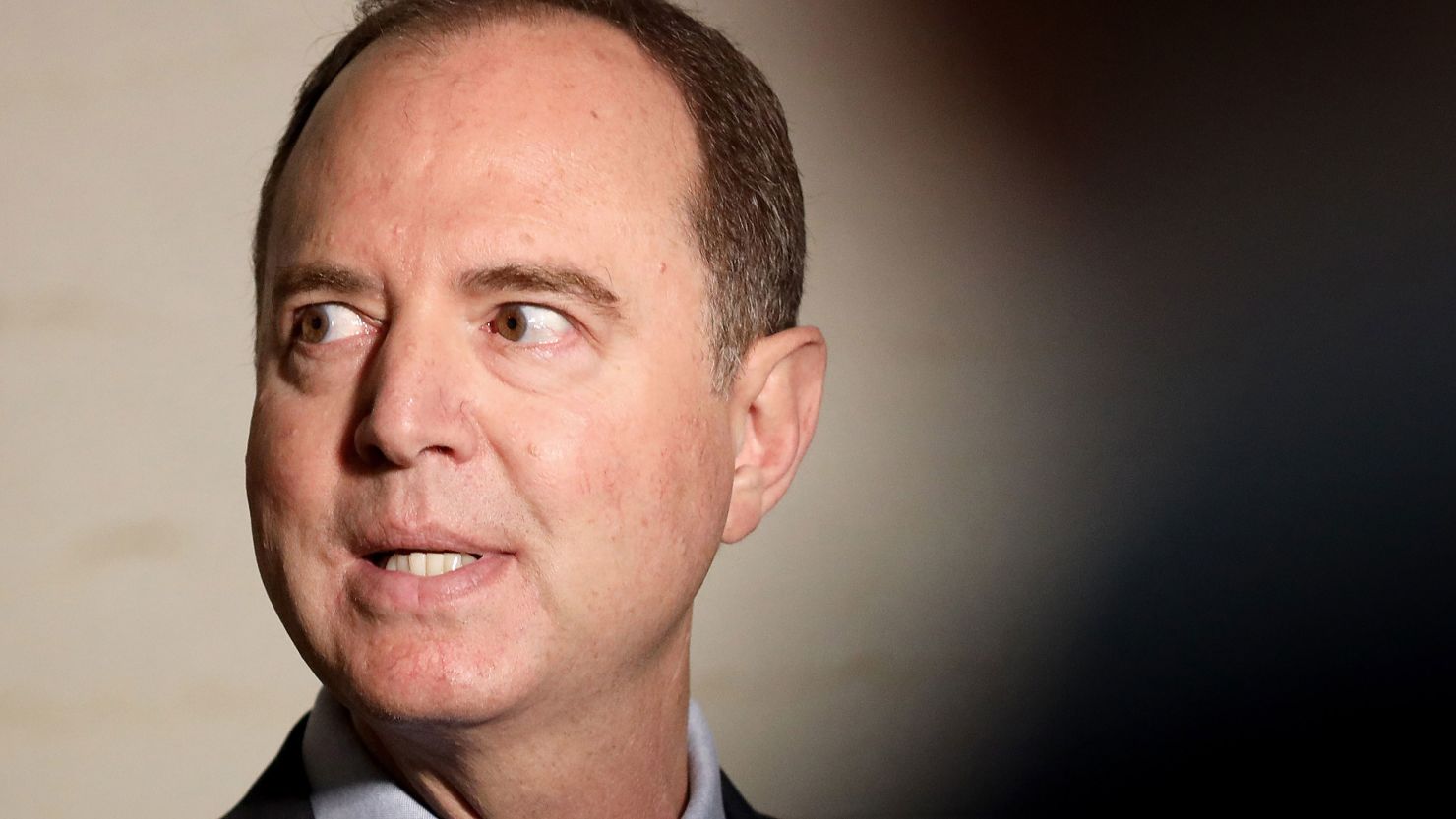

A once-obscure case tied to U.S. Representative Adam Schiff now threatens to spiral into a federal investigation, with growing claims that banks were misled for lucrative advantage. At the center of it is a sharp rebuke from a former NYPD official—bluntly stating, “Banks were cheated.” Those words, now echoing across newsrooms and legal circles, have raised urgent questions about surveillance, conflict of interest, and the line between political accountability and criminal exposure.

The Accusation: Mortgage Fraud and Bank Misrepresentation

Earlier this year, former President Donald Trump reignited his longstanding feud with Rep. Adam Schiff (D-Calif.), alleging a “sustained pattern of possible mortgage fraud.” Trump cited analysis from the Federal Housing Finance Agency (FHFA), which oversees Fannie Mae, as alleging that Schiff falsely declared his Maryland property as a primary residence to secure favorable mortgage terms. Trump demanded justice, calling for: “Schiff … brought to justice,” via his social media platforms.

Simultaneously, various press outlets report that a federal probe is underway in Maryland, scrutinizing Schiff’s mortgage transactions and residency claims. If the case escalates, it might become one of the most politically loaded federal investigations in recent history.

“Banks Were Cheated”: A Former NYPD Officer Speaks Out

Adding new fuel to the controversy, a retired NYPD official—well-respected for his experience in financial investigations—publicly declared that the banks involved “were cheated” in this transaction. Though his name remains undisclosed, his perspective lends an investigative heft to the fraud allegations, positing that the misrepresentation may have directly impacted mortgage issuance and risk profiling.

Interpretation and Implications

If banks relied on fraudulent residency information to determine qualified rates, the issue clearly extends beyond politics—it cuts to banking integrity and regulatory oversight failures. Under federal law, intentionally falsifying key mortgage information can qualify as material misrepresentation and potentially mortgage fraud, punishable under 18 U.S.C. § 1014.

Comparative Insight: What Could a Federal Takeover Mean?

If this case goes federal, here’s how it might unfold:

DOJ or FBI Involvement: A federal warrant could authorize seizure of bank records, communication logs, and internal underwriting assessments.

Criminal Exposure: If falsified residency materially influenced loan terms, it could elevate the case to criminal charges—not just civil penalties.

Financial Repercussions: Banks could pursue restitution if they can prove loss due to misrepresented borrower profile.

This would move the spotlight from politics into criminal law—unfortunately, landing Schiff in untested territory of moral and legal jeopardy.

Schiff’s Response: Denial and Defense

Rep. Schiff has fired back, calling the mortgage fraud allegations politically motivated and baseless. His team notes that lenders knew he had multiple residences, and he claims full transparency in filings

Schiff further framed the allegations as continuation of Trump’s broader strategy to target his political opponents—tagging it a “revenge play” masked as a law enforcement action.

Precedent and Broader Relevance

This isn’t the first time lawmakers have faced mortgage-related probes—yet few have reached federal threshold for prosecution. Typically such cases involve high-profile opponents of the administration, drawing claims of weaponization of justice. The outcome could pivot on whether the facts suggest intent to deceive lenders, or if this remains a case of bureaucratic misunderstanding.

Voices of the Financial Community

Key questions now swirl among banking compliance experts:

Did the bank truly rely on Schiff’s residency claim when setting loan terms?

Were internal compliance protocols followed, or overlooked?

What precedent would criminalizing inflated residency claims set for other politicians or professionals with multiple homes?

The former NYPD official’s accusation that “banks were cheated” suggests at least that financial institutions didn’t receive the transparency they expected—challenges both ethical and legal.

Public Repercussions and Political Fallout

If charges are brought:

Schiff’s credibility as a policy hawk and ethics advocate could be deeply undermined.

Democrats might scramble to unify behind him or distance themselves—depending on emerging evidence.

Republicans would likely amplify the narrative of hypocrisy, especially given Schiff’s prominence as a Trump critic.

Alternatively, if the probe stalls, Schiff might seize on political backlash as evidence of selective enforcement—fueling arguments of a partisan justice system.

Final Thoughts: A Case at the Crossroads of Law and Politics

From the blunt words of a former NYPD official to the threat of a federal probe, the Adam Schiff mortgage allegation now stands at a consequential crossroads. If banks truly “were cheated,” the fallout transcends politics—it becomes a question of transparency, accountability, and the limits of power.

At this stage, the key questions remain:

Will federal investigators take the case forward?

Is there enough evidence of intent and deception for prosecution?

How will public perception shift as more documents—or defenses—emerge?

Ultimately, the path from political rancor to courtroom drama remains uncertain. But one thing is clear: the case now has all the makings of a defining moment—on both Capitol Hill and in the federal judiciary.

News

New Colossus: The World’s Largest AI Datacenter Isn’t What It Seems

In a quiet corner of the American Midwest, a sprawling facility has been generating whispers among tech insiders, policy analysts,…

Kayleigh McEnany: This is Sending the World a Message

Kayleigh McEnany, former White House Press Secretary and political commentator, has long been recognized for her unflinching communication style and…

Candace Says Thiel, Musk, Altman NOT HUMAN

In a statement that has sparked widespread discussion across social media and news platforms, conservative commentator Candace Owens recently claimed…

Judge Pirro Reveals HARDEST Part of Job as US Attorney

Judge Jeanine Pirro is a household name in American media and law, known for her sharp wit, commanding presence, and…

Harris Faulkner: This Could Potentially EXPLODE

In the constantly shifting landscape of American media, few figures have sparked as much debate, admiration, and scrutiny as Harris…

Kaido is CRASHING OUT After Salish DUMPS Him For Ferran (Nobody Saw This Coming)

When word broke that Salish Matter had dumped Kaido and seemingly moved on with Ferran, the internet didn’t just react…

End of content

No more pages to load