April 2024 – March 2025 — In a series of incendiary remarks, Dustin Moskovitz, co-founder of Facebook and current CEO of Asana, has publicly accused Tesla of committing “consumer fraud on a massive scale,” warning that the company is headed for a collapse like Enron—and that its executives, including Elon Musk, could ultimately face jail time.

These allegations, shared on Threads and amplified across platforms including Reddit and news outlets, have sparked intense backlash and prompted broader scrutiny of Tesla’s accounting, Full Self-Driving (FSD) claims, and corporate transparency.

The Bombshell Claims: “Tesla Is the Next Enron”

On April 26, 2024, Moskovitz posted on Threads:

“This is Enron now, folks … it may keep going, but people are going to jail at the end.”

He alleged that Tesla had engaged in massive consumer fraud—misleading customers about its FSD capabilities, overstating electric vehicle ranges, and even inflating odometer readings. He further suggested that revenue recognition tied to deferred service contracts—particularly Tesla’s Autopark rollout—was intentionally miscategorized as earned revenue.

Allegations in Focus: What Moskovitz Points At

Moskovitz singled out several corporate practices:

Misleading FSD and Autopark claims, suggesting Tesla exaggerated performance to boost deferred revenue recognition.

Overstated vehicle range, where dashboard displays may show inflated estimates that mislead buyers—something third-party tests found divergent from reality. Odometer overstatement, potentially impacting lease agreements or resale values, raising legal concern.

These assertions, Moskovitz claimed, were not rookie mistakes but reflections of underlying systemic accounting misrepresentation.

The “Consumer Fraud” Warning: Jail on the Horizon?

Referencing Tesla’s own promotional graph celebrating one billion miles driven on FSD, Moskovitz argued the milestone was presented ambiguously—missing precise dates and built in a way to suggest smoother product progression than truly occurred.

His explicit tone: Tesla may persist in business—but in the mold of Enron, whose executives faced legal consequences after revenue misstatements and accounting fraud schemes were exposed. “People are going to jail at the end,” he declared—adding that the deception was no mere oversight.

:quality(75)/media/dinero/images/2023/03/elon-musk-errores-aciertos.jpg)

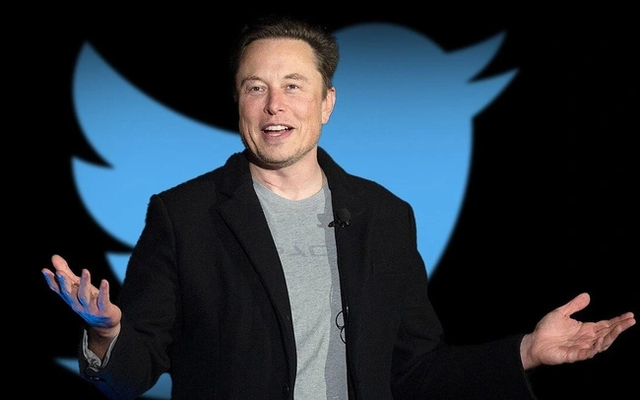

Musk’s Reaction: Ridicule and Sarcastic Replies

Elon Musk responded dismissively—in one instance calling Moskovitz a “pompous idiot” and joking he should go to jail for “impersonating a smart person.” Later, Musk issued a sarcastic apology for using a slur, clarifying “What I meant to say is that he is a pompous idiot…”

He has not addressed the substance of Moskovitz’s claims in detail, instead opting for personal insults and dismissals rather than substantive rebuttal or apology.

![]()

Broader Context: Tesla’s History of Financial Criticism

Tesla has faced ongoing scrutiny:

The SEC fined Musk and Tesla $20 million each in 2018 over Musk’s tweet claiming “funding secured” to take Tesla private—deemed securities fraud.

In 2020 and beyond, critics including hedge fund manager David Einhorn raised alarms about Tesla’s accounting: revenue accruals, accounts receivable, and lease recognition policies.

Tesla’s shift in accounting rules regarding vehicle leases allowed faster revenue recognition—though critics argue some of these practices may distort true financial performance.

Moskovitz portrays these patterns as emblematic of deeper misconduct—not isolated errors.

Community Echo: Reddit Speaks

On Reddit, Tesla critics amplified Moskovitz’s warnings. One user commented:

“FSD = Fraudulent Shares Dupe … This is a clear pump and dump.”

Others described odometer discrepancies and overpromised performance as symptomatic of systematic deception:

“Elon promising … that is not possible ever … limitations too severe.”

Voices across forums expressed belief that the company relies heavily on hype and narrative instead of performance.

Expert & Industry Reactions

Analysts stress nuance: Tesla’s practices may indeed push accounting boundaries, but calling them criminal without full audits is premature.

Nutrition in Forbes:

Revenue recognition tied to subscriptions like Autopark must follow GAAP rules and is standard in tech and automotive.

Range claims, though optimistic, reflect EPA estimates and ride-sharing use—while critics note real-world tests show significant divergence.

Still, unsatisfied shareholders and regulators have questioned Tesla multiple times, including an ongoing autopilot safety probe by U.S. auto regulators.

Potential Fallout: Could It Be Legal?

◆ SEC and DOJ Risk

Given past cases, if Moskovitz’s claims are investigated and proven—especially regarding misuse of deferred revenue for auto subscriptions or misleading investor disclosures—Musk and leadership could face legal jeopardy.

◆ Consumer Class Action

Lawsuits alleging false advertising of FSD capabilities, inflated range, or odometer manipulation could emerge. Tesla previously settled such actions, but large-scale suits could cause reputational damage.

◆ Investor Confidence

Shares have swooned during volatility tied to these controversies. Moskovitz’s high-profile warnings may accelerate scrutiny by institutional investors and watchdogs.

Conclusion: Provocation or Prophecy?

Dustin Moskovitz’s allegations—Tesla is headed for bankruptcy and Musk will go to prison—are provocative. He paints an electric car empire built on inflated claims and creative financial practices. While some critics see merit in asking tough questions, experts caution that legal liability remains unproven.

Elon Musk’s response—mocking and personal—may have deflected discomfort but not dismissed the substance of the accusations. Tesla has weathered criticism before, yet this moment may reframe public expectations around accountability and transparency.

Whether Musk’s leadership or Tesla’s financial architecture can withstand forensic scrutiny remains to be seen. If Moskovitz is right, Tesla could be not just the Enron of EV—but a cautionary tale of Silicon Valley hubris. But absent formal investigations or admissions, his prediction remains a flash point: bold, bitter—and as yet unverified.

News

New Colossus: The World’s Largest AI Datacenter Isn’t What It Seems

In a quiet corner of the American Midwest, a sprawling facility has been generating whispers among tech insiders, policy analysts,…

Kayleigh McEnany: This is Sending the World a Message

Kayleigh McEnany, former White House Press Secretary and political commentator, has long been recognized for her unflinching communication style and…

Candace Says Thiel, Musk, Altman NOT HUMAN

In a statement that has sparked widespread discussion across social media and news platforms, conservative commentator Candace Owens recently claimed…

Judge Pirro Reveals HARDEST Part of Job as US Attorney

Judge Jeanine Pirro is a household name in American media and law, known for her sharp wit, commanding presence, and…

Harris Faulkner: This Could Potentially EXPLODE

In the constantly shifting landscape of American media, few figures have sparked as much debate, admiration, and scrutiny as Harris…

Kaido is CRASHING OUT After Salish DUMPS Him For Ferran (Nobody Saw This Coming)

When word broke that Salish Matter had dumped Kaido and seemingly moved on with Ferran, the internet didn’t just react…

End of content

No more pages to load