Executive Summary

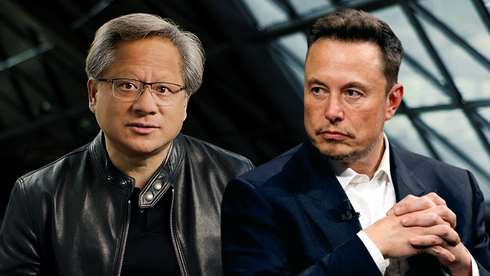

On July 28, 2025, Tesla CEO Elon Musk publicly confirmed that Samsung Electronics will manufacture Tesla’s next-generation AI6 custom chips under a landmark $16.5 billion, eight-year contract. That deal, previously disclosed in Samsung’s regulatory filing, runs from July 26, 2025 to December 31, 2033. Musk emphasized the strategic importance of Tesla’s collaboration with Samsung—declaring he would personally oversee production optimization and praising the deal’s role in bolstering U.S. semiconductor infrastructure .

This move marks a pivotal moment in Tesla’s evolution—from merely manufacturing electric vehicles to becoming a comprehensive AI and robotics company. The chips will power Tesla’s Full Self‑Driving (FSD) system, its upcoming Optimus humanoid robot, and potentially AI training workloads for its Dojo supercomputer infrastructure .

The Deal and Its Scope

Samsung confirmed in its regulatory filing a 22.8 trillion‑won (~USD 16.5 billion) foundry contract with a “global company,” later revealed by Musk to be Tesla . Musk clarified on X that:

Samsung will produce Tesla’s AI6 chip at its Taylor, Texas fabrication plant—a facility built to host advanced nodes including 2nm-class ﹘ accelerated by U.S. CHIPS Act subsidies .

Production is expected to begin ramping around 2026–2028, depending on Samsung’s 2nm process yield optimization .

The contract runs through 2033, and Musk hinted that the $16.5B figure is a baseline—actual volumes could be several times higher as Tesla scales chip usage for vehicles, robotics, and AI data centers .

Strategic Importance for Tesla

Tesla’s prior AI chips—AI4 (formerly HW4) and the earlier AI5—were split between Samsung (AI4) and TSMC (AI5). With AI6, Tesla consolidates production back with Samsung, expanding its hardware ambitions beyond autos into large-scale AI deployment .

AI6 is designed for versatility: to scale from in‑car inference for FSD, to powering Optimus humanoid robots, and handling AI training workloads on Tesla’s Dojo infrastructure .

By collaborating closely with Samsung on chip design and yield optimization, Tesla enhances vertical integration of hardware and software, reducing reliance on third-party GPU suppliers like Nvidia for AI processing .

Musk stated he would take a “founder-mode” role—visiting the Texas fab regularly to “walk the line personally” to ensure production quality and speed .

Benefits and Risks for Samsung

The agreement is Samsung Foundry’s largest-ever single‑customer contract, worth about 7.6% of its 2024 revenue, and crucial to reviving its lagging high-end foundry business (with global market share of roughly 7–8%, compared to TSMC’s 67%) .

Analysts see multiple benefits:

Credibility boost: Securing Tesla, an exacting client, helps Samsung demonstrate viability in producing top-tier AI chips.

Texas fab activation: Located near Musk’s residence, the Taylor plant was delayed and lacked large customers—this deal provides volume and U.S.-based supply chain resilience driven by CHIPS Act incentives .

Technology advancement: Supports deployment of Samsung’s 2nm-class SF2A node, critical in catching up to competitors .

But risks remain:

Yield pressure: Samsung has historically struggled with production yields in advanced nodes. Tesla’s aggressive expectations could strain operations.

Profitability questions: Analysts warn that Samsung may have offered generous contract terms to win Tesla’s business, possibly undermining margins despite the headline value .

Timeline and Product Roadmap

Tesla began deploying HW4/AI4, built by Samsung, in 2023, equipping Model S and Model Y chassis with improved computational power over HW3 .

The AI5 iteration is currently being manufactured by TSMC, initially in Taiwan and later at its Arizona fab .

With AI6, Tesla consolidates to Samsung’s Texas plant—optimistically targeting multi-purpose use across vehicle autonomy, robotics, and AI infrastructure by as early as 2028 .

Market Reactions and Competitive Implications

Stock & Financial Markets

Samsung shares rallied 6–7% on the news, adding approximately $20 billion in market capitalization.

Tesla shares rose around 1–4%, though some analysts remain cautious due to macro headwinds and regulatory uncertainties .

Conversely, TSMC stock declined modestly (~1–1.8%) amid investor concerns over losing future Tesla chip volumes .

Foundry Landscape Shift

The collaboration signals Tesla’s intent to diversify its suppliers—reducing dependence on Asian fabs and increasing U.S.-based production.

It reshapes the narrative of the global foundry race: Samsung now competes not just on memory chips, but also on high-end AI logic fabrication versus TSMC .

Challenges Ahead

Technical risk: Delivering high yields on Samsung’s 2nm-class node remains uncertain. Any delays could push back AI6 deployment and impact Tesla’s robotics/AI timeline.

Operational oversight: Musk’s hands-on involvement may help—but consistent product quality at scale is a substantial challenge.

Strategic risk: If Samsung underperforms, Tesla may need fallback plans or risk delays across its next-gen vehicle/software roadmap.

Additionally, Tesla must manage:

Regulatory scrutiny around autonomous driving and AI adoption.

Supply chain disruptions, particularly U.S.-China trade tensions.

Investor expectations shifting from car sales to AI‑based growth and robotaxi deployment.

Broader Significance & Future Outlook

The Tesla–Samsung chip deal is not merely a procurement contract—it is a strategic alliance reflecting Tesla’s transition toward an AI-first company, powering autonomy, robotics, and internal AI training.

For Tesla: Vertical hardware‑software synergy becomes more tightly integrated. AI6 may underpin Optimus batteries, robotaxis, FSD systems, and even Tesla’s competitive edge in AI compute.

For Samsung: The partnership offers a marquee customer and credibility boost, essential to reviving its foundry presence in the high-stakes arena dominated by TSMC.

For the industry: It advances U.S.-based semiconductor production and signals a potential shift in supplier strategies among major AI companies – balancing geopolitical risk with performance.

If Samsung hits its promised yield targets and Tesla scales AI6 production aggressively, the deal could easily exceed the baseline $16.5B investment, forming a backbone of Tesla’s AI hardware for the rest of the decade.

Conclusion

On July 28, 2025, Elon Musk confirmed a transformative partnership: Tesla will now rely on Samsung’s Texas-based foundry to make its AI6 chips under a $16.5 billion baseline contract running through 2033. The chips are designed for broad AI functionality—from onboard vehicle autonomy to teaching Tesla’s Optimus robots and powering its proprietary Dojo infrastructure. While the deal offers both sides strategic benefits—Tesla gains tighter vertical integration; Samsung gains a high-profile AI client—execution risk remains high, centering on chip yield, production ramp-up, and long-term profitability.

This agreement illustrates Tesla’s deliberate pivot from an automaker to an AI and robotics powerhouse—and Samsung’s re-emergence as a credible challenger in advanced logic chip production. Whether this bet pays off will hinge on technical execution, efficient ramp-up, and Tesla’s ability to leverage AI6 across all facets of its business.

News

New Colossus: The World’s Largest AI Datacenter Isn’t What It Seems

In a quiet corner of the American Midwest, a sprawling facility has been generating whispers among tech insiders, policy analysts,…

Kayleigh McEnany: This is Sending the World a Message

Kayleigh McEnany, former White House Press Secretary and political commentator, has long been recognized for her unflinching communication style and…

Candace Says Thiel, Musk, Altman NOT HUMAN

In a statement that has sparked widespread discussion across social media and news platforms, conservative commentator Candace Owens recently claimed…

Judge Pirro Reveals HARDEST Part of Job as US Attorney

Judge Jeanine Pirro is a household name in American media and law, known for her sharp wit, commanding presence, and…

Harris Faulkner: This Could Potentially EXPLODE

In the constantly shifting landscape of American media, few figures have sparked as much debate, admiration, and scrutiny as Harris…

Kaido is CRASHING OUT After Salish DUMPS Him For Ferran (Nobody Saw This Coming)

When word broke that Salish Matter had dumped Kaido and seemingly moved on with Ferran, the internet didn’t just react…

End of content

No more pages to load