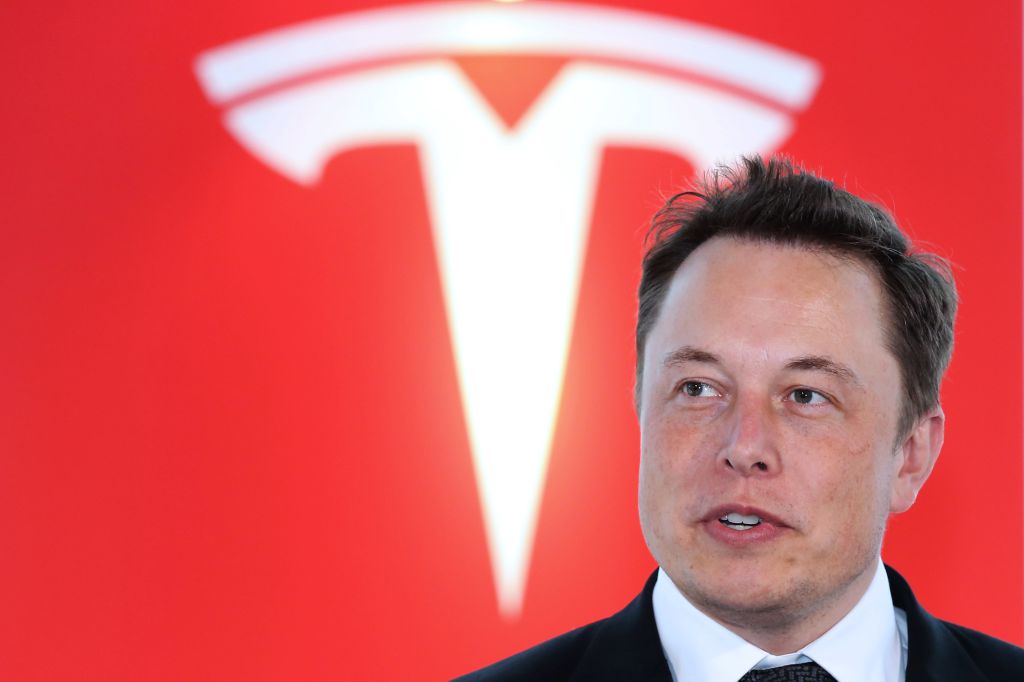

Elon Musk, the maverick entrepreneur who helms Tesla, has once again captured headlines—not just for his futuristic vision but for a potential fortune that could eclipse every compensation package in corporate history. Indeed, Tesla has proposed an eye-popping pay package that could turn Musk into the first trillionaire—but only if the company hits an array of extraordinary milestones.

This report dissects the conditions, legal context, and implications of this unprecedented compensation plan, revealing how ambition and governance collide at the nexus of power and innovation.

:max_bytes(150000):strip_icc():focal(749x0:751x2)/elon-musk-tesla-080425-ccb15754843b414cb59af2e285472ef0.jpg)

The Trillion-Dollar Trigger: What Must Musk Achieve?

Tesla’s newly proposed compensation plan conditions Musk’s payday on completing an extraordinary series of goals over the next decade. According to regulatory filings:

Market Value Leap: Tesla’s market capitalization must leap from just over $1 trillion to $8.5 trillion—effectively positioning Tesla as the highest-valued company ever.

Staggered Vesting Mechanism: The plan involves awarding Musk up to12% additional equity, delivered in 12 tranches. Vesting begins once Tesla hits a $2 trillion valuation and accelerates with each subsequent milestone.

Operational Milestones:

20 million annual vehicle deliveries—a monumental leap from current levels.

Deployment of 1 million robotaxis.

Production and deployment of 1 million AI humanoid robots.

Time and Loyalty Requirements: Musk must stay at Tesla for at least 7.5 years to unlock any portion of the package, with the full payout only accessible after 10 years of continued leadership.

If Tesla meetsall these targets by 2035, Musk stands to become the world’s first trillionaire, with his ownership rising from around 16% to over 25%.

Legal Landscape: A Board in Boldness, Courts in Contention

This proposed payday comes amid a backdrop of legal and corporate governance turmoil:

Past Compensation Voided: Musk’s earlier 2018 compensation package—potentially worth up to $56 billion—was voided by a Delaware court in January 2024. The judge ruled it was unfairly approved under a conflicted board and flawed process.

Appeals and Shareholder Backlash: Tesla appealed the ruling and even re-ratified the package through shareholder votes. But the court upheld its decision, calling the process “unfathomable.”

New $29–30 Billion Interim Award: As a stopgap, Tesla’s board awarded Musk 96 million restricted shares worth roughly $29–30 billion in August 2025—intended to retain him amid ongoing legal wrangling. If the appeal succeeds and the original deal is reinstated, this interim award would be canceled

Move to Texas for Legal Shield: To reduce shareholder lawsuit risks, Tesla reincorporated in Texas, where a minimum 3% ownership is required to sue—an advantage Musk and major institutions hold.

Why the Board Is Pushing So Hard

Tesla’s board is clear: Musk’s continued leadership is indispensable, especially as Tesla pivots into AI and robotics. They believe:

His visionary drive will push Tesla into new realms of innovation and keep momentum against rising competition. The ambitious plan aligns pay with performance—shareholders benefit only if Tesla radically ascends.

The package also serves as a retention tool, locking Musk into Tesla leadership for up to a decade—even as his attention spans across multiple ventures.

Risks and Skepticism

Not everyone views the proposal favorably:

Governance Concerns: Critics argue the size and structure of the package reflect weak oversight. Musk’s boosted voting control raises eyebrows about board independence.

Feasibility Doubts: Targets—like 20 million vehicles per year or mass robot deployments—are far-fetched compared to current production and technological readiness.

Public and Investor Pushback: Shareholders and governance watchdogs (e.g., New York State Comptroller) criticize the plan as opportunistic, especially with Tesla’s faltering sales and Musk’s political controversies.

What’s at Stake

If approved by shareholders in the November 6 meeting (in Texas), this compensation deal would transform Musk’s entanglement with Tesla—and potentially the company’s trajectory:

For Musk: A successful payout cements his wealth and influence, perhaps even surpassing his ambitions for colonial space missions or AI ventures.

For Tesla: Meeting these goals would not only reward Musk but fundamentally reshape Tesla into a robotics and AI powerhouse—if successful.

For Shareholders: They stand to gain from any growth—but face significant dilution and governance risk if Musk consolidates even more power.

Conclusion

The headline is jaw-dropping: Elon Musk could earn atrillion-dollar payday—but only if Tesla clobbers current records in valuation, production, and innovation. It’s a high-stakes bet that no CEO in history has ever faced. While the proposal aligns Musk’s incentive with Tesla’s long-term success, it also spotlights the fine line between visionary leadership and unchecked power.

Whether this becomes reality depends on shareholder votes, legal battles, and Tesla’s ability to pull off what looks, on paper, like missions from science fiction. But if any leader in corporate America could come close? It’s Elon Musk—and Tesla appears willing to stake the future on it.

News

New Colossus: The World’s Largest AI Datacenter Isn’t What It Seems

In a quiet corner of the American Midwest, a sprawling facility has been generating whispers among tech insiders, policy analysts,…

Kayleigh McEnany: This is Sending the World a Message

Kayleigh McEnany, former White House Press Secretary and political commentator, has long been recognized for her unflinching communication style and…

Candace Says Thiel, Musk, Altman NOT HUMAN

In a statement that has sparked widespread discussion across social media and news platforms, conservative commentator Candace Owens recently claimed…

Judge Pirro Reveals HARDEST Part of Job as US Attorney

Judge Jeanine Pirro is a household name in American media and law, known for her sharp wit, commanding presence, and…

Harris Faulkner: This Could Potentially EXPLODE

In the constantly shifting landscape of American media, few figures have sparked as much debate, admiration, and scrutiny as Harris…

Kaido is CRASHING OUT After Salish DUMPS Him For Ferran (Nobody Saw This Coming)

When word broke that Salish Matter had dumped Kaido and seemingly moved on with Ferran, the internet didn’t just react…

End of content

No more pages to load