South Africa is witnessing a high‑stakes confrontation between its Black Economic Empowerment (BEE) laws and Elon Musk’s satellite broadband company, Starlink (part of SpaceX). The conflict revolves around licensing, ownership, and what kind of equity or investment foreign firms must commit in order to do business in the country. With Starlink proposing a R2 billion investment (≈ USD 110‑115 million) to roll out broadband, especially in rural and underserved areas, this showdown is quickly becoming emblematic of larger debates: transformation vs global investment, regulation vs innovation, fairness vs economic opportunity.

This article examines what is known so far, who the key players are, what is at stake, and what outcomes might emerge.

What is South Africa’s BEE / BBBEE Framework?

To understand the debate, one must grasp South Africa’s Broad‑Based Black Economic Empowerment policy (B‑BEE or BBBEE).

Post‑apartheid, SA introduced BEE laws to address systematic inequalities, giving historically disadvantaged groups (mainly Black South Africans, women, youth, people with disabilities) greater participation in the economy.

In sectors such as telecommunications, foreign or non‑local companies seeking licenses must meet local ownership rules: typically at least 30% equity must be owned by these disadvantaged groups.

There are debates and policy instruments like Equity Equivalent Investment Programmes (EEIPs), which allow companies to meet transformation goals not by giving direct ownership, but by making contributions in skills development, infrastructure, supplier growth, and other “equivalent” investments.

These laws are central to the political economy in South Africa; they are not optional or cosmetic.

What Starlink Wants & What Has Been Proposed

Starlink, owned by Elon Musk, wants to operate in South Africa but has encountered regulatory barriers. Here are the main pieces of what Starlink is proposing, what the government has responded, and where the friction lies:

Starlink’s Investment Proposal

Starlink has stated it is willing to invest about R2 billion to expand broadband access in the Southern African Development Community region. Part of the pitch includes bringing better internet connectivity to rural schools and remote areas.

For example, one of its proposals is to provide free high‑speed internet and full‑kit installations for 5,000 rural schools, if regulatory requirements are eased.

The Barrier: 30% Ownership Rule

To legally obtain telecommunications licenses under SA law, foreign telecom and network operators are required to have 30% of local equity owned by historically disadvantaged groups. Starlink says this ownership requirement is a barrier to its entry.

Elon Musk has publicly claimed that because he is not Black, this rule prevents his company from operating in SA. His statement: “Starlink is not allowed to operate in South Africa, because I’m not black.” This has drawn both support and skepticism.

Government’s Proposed Policy Adjustment: EEIPs

In response, the Department of Communications and Digital Technologies proposed recognizing Equity Equivalent Investment Programmes (EEIPs) as an alternative path. Under EEIPs, instead of transferring equity, foreign firms could contribute through skills development, infrastructure, digital inclusion, or supplier development.

Communications Minister Solly Malatsi has defended this policy direction, saying it is not a special deal for Starlink, but a broader effort to lower regulatory hurdles and attract investment while still preserving transformation goals.

:max_bytes(150000):strip_icc()/GettyImages-1258741760-1bc7f77d4aa14907a27e7a265a55e314.jpg)

Regulator & Licensing Status

The telecom regulator, ICASA (Independent Communications Authority of South Africa), has confirmed that Starlink has not yet applied for the required licenses (I‑ECNS or I‑ECS) to operate legally in SA.

ICASA has also warned the public about using Starlink equipment or services without proper licensing, and raised concerns about non‑approved hardware interfering with spectrum.

Key Tensions & Political Reactions

This issue has become a flashpoint for broader political, legal, and social arguments. Key players and positions:

Elon Musk / Starlink — Argues that the ownership requirement is a barrier: it impedes ability to maintain global control over the network, is difficult for global corporations to meet, and limits their ability to provide connectivity in rural or remote areas without such burdens. Musk frames the requirement as discriminatory.

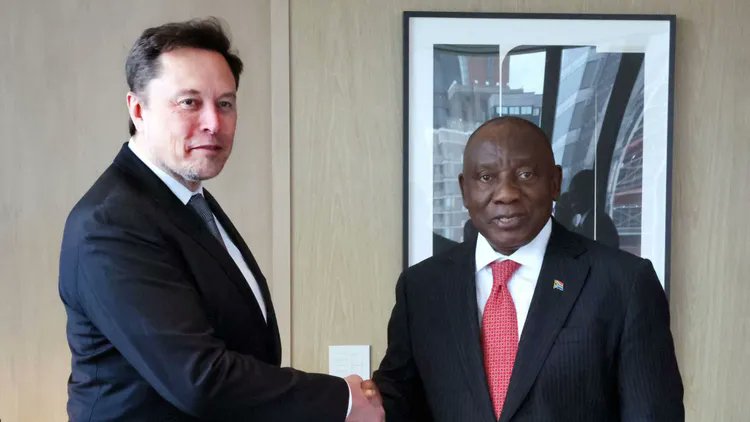

South African Government — Particularly Communications Minister Malatsi maintains that while reforms are under consideration, laws are not being removed for one company. The EEIP model is seen as a compromise. The government insists that transformation remains non-negotiable. President Ramaphosa has emphasized that transformation (economic inclusion of Black South Africans) must go hand in hand with growth and investment.

Opposition / Civil Society

The Economic Freedom Fighters (EFF) argue that Starlink should comply with existing BEE law — no exemptions.

Black Business Council warns against bypassing or weakening the 30% law just for Starlink, citing risks of setting bad precedents.

Others warn that any “tailor‑made” loosening for Starlink undermines the spirit of transformation and could erode trust in BEE policy.

Public & Rural Connectivity Advocates — Some see Starlink’s entry as important for improving internet access in rural, underserved areas. They argue that delays due to regulatory barriers perpetuate digital inequality. Others are cautious that foreign players get too much leeway at the expense of local firms.

Stakes: What’s at Risk

With R2 billion (≈ USD 110‑115 million) on the line, this is more than a technical licensing issue. The outcome could influence:

Digital Access & Rural InclusionIf Starlink is allowed to roll out, especially under flexible conditions, rural South Africa could see faster internet, better connectivity in schools, remote areas, possibly boosting education and economic opportunity. But if it remains blocked or constrained, those areas may be left behind.

Policy Precedents & Regulatory IntegrityEasing BEE ownership rules for one large firm could set precedent that other multinationals might seek. This raises questions: will regulations continue to be applied uniformly? Will foreign investment be conditional on transformation always? And how to balance the need for investment with the urgency of equity?

Investor Confidence & CompetitivenessFor tech and telecom investors, how SA handles Starlink could signal how open or rigid its regulatory environment is. If policies are seen as unpredictable or subject to political exceptions, that may discourage investment in other sectors.

Political Focus & Social EquitySouth Africa’s population is still unequal by race, geographic location, wealth, and digital access. BEE remains a deeply symbolic and material policy for many. Any perception of weakening could spark political backlash, erosion of public trust, or renewal of debates about transformation’s scope, fairness, and enforcement.

Economic Cost of Delay

The longer Starlink (and similar providers) remain off the table, the more rural communities remain unserved. Some may use services illegally or through workarounds—creating regulatory headaches or safety issues. Meanwhile, competitors in neighboring countries may gain envy or advantage.

What Remains Unclear

While much has been reported, several important details are still murky:

Has Starlink formally submitted any license application since the policy proposals? If yes, what was ICASA’s response? Some reports say no.

What exact workaround will the EEIPs require? What metrics will be used (investment, jobs created, supplier development, infrastructure deployment)? How will they be enforced, monitored, and audited?

Whether any changes to law (BEE policy, ICT sector code, licensing regulations) will be legislated or if they remain policy directives. Will the Electronic Communications Act or its licensing conditions be amended?

Will this lead to a “special carve‑out” for Starlink, or will the same flexibility be extended to all foreign telecom firms? Critics worry about fairness.

What will be the cost to government and taxpayers? If Starlink is allowed via EEIP but retains control without equity share, will locals benefit as much (in ownership, revenue, jobs)?

Timeline of Key Events

Early 2025 – Starlink publicly states desire to enter SA market; Musk criticizes the 30% BEE requirement as discriminatory.

February‑March 2025 – Government and regulatory bodies respond; some pressure builds from rural access advocates. ICASA points out that no license application by Starlink has been filed yet.

23 May 2025 – A new proposed policy direction is gazetted by the Department of Communications & Digital Technologies, introducing EEIPs as an option.

May‑June 2025 – Parliament committee hearings, public controversy, political opposition, and statements affirming government is not making special deals, even as policy flexibilities are explored.

What Outcomes Are Likely / Possible Scenarios

From the evidence, several outcomes seem plausible:

EEIP Approved, Starlink Enters under New TermsThe policy direction may be formalised, allowing Starlink to operate via contributions rather than giving up 30% equity. This is perhaps the most balanced outcome government seems predisposed toward. It would allow expansion of services, meet transformation goals in alternate ways, and bring rural connectivity improvements.

Full Compliance (30% Ownership) or Local Partnered Structure

Starlink could comply with the existing ownership rule by finding South African partners, transferring equity, or creating a local subsidiary with required ownership. This may be more politically acceptable to critics, though Starlink claims it is hard to maintain global control structure if it must give up that equity.

Delays / Legal ChallengesIf the policy remains in draft form, or is challenged by opposition parties, civil society, or legal bodies, there might be delay. Perhaps court challenges on constitutionality, fairness, or consistency could emerge.

Political Blowback or CompromiseGovernment may come under pressure from both sides: those wanting rural broadband access fast, others wanting transformation rules strictly upheld. A compromise may emerge that attempts to balance both — for example, stricter EEIP requirements, transparent oversight, share of revenue, or phased equity transfer.

Starlink Decides Not To Enter

If regulatory barriers remain high and the cost of meeting BEE in either formal equity or equivalent investment is too steep, Starlink might postpone or withdraw entry plans. Meanwhile, rural users might continue to use unlicensed or grey‑market equipment, or rely on different providers.

Different Perspectives

Supporters of Starlink argue that easing ownership rules in this case could significantly improve internet access, reduce the “digital divide,” help education, remote work, and rural enterprise. They consider ownership requirements as outdated obstacles in the age of global operations.

Transformational justice advocates counter that BEE exists for a reason: to correct centuries of structural racial exclusion. They view any weakening as a slippery slope, leading to foreign firms operating without enough benefit flowing to historically disadvantaged South Africans.

Regulatory / Legal experts emphasize that laws must be applied fairly, with transparency, and with checks. If EEIPs are adopted, the standards and their implementation will matter a great deal—loopholes could distort intended benefits.

Conclusion

The “Starlink’s R2 Billion BEE Showdown” is not just a corporate drama; it’s a microcosm of South Africa’s ongoing challenge: how to reconcile the legacies of inequality with the demands of global investment and innovation.

While Starlink has proposed significant investment and has made offers around connecting schools and rural areas, its objection to the 30% ownership requirement poses legitimate questions about national policy, sovereignty, and fairness. The government’s proposal of Equity Equivalent Investment Programmes offers a potential path forward, but it must be implemented carefully and in a way that doesn’t erode the core goals of transformation.

News

New Colossus: The World’s Largest AI Datacenter Isn’t What It Seems

In a quiet corner of the American Midwest, a sprawling facility has been generating whispers among tech insiders, policy analysts,…

Kayleigh McEnany: This is Sending the World a Message

Kayleigh McEnany, former White House Press Secretary and political commentator, has long been recognized for her unflinching communication style and…

Candace Says Thiel, Musk, Altman NOT HUMAN

In a statement that has sparked widespread discussion across social media and news platforms, conservative commentator Candace Owens recently claimed…

Judge Pirro Reveals HARDEST Part of Job as US Attorney

Judge Jeanine Pirro is a household name in American media and law, known for her sharp wit, commanding presence, and…

Harris Faulkner: This Could Potentially EXPLODE

In the constantly shifting landscape of American media, few figures have sparked as much debate, admiration, and scrutiny as Harris…

Kaido is CRASHING OUT After Salish DUMPS Him For Ferran (Nobody Saw This Coming)

When word broke that Salish Matter had dumped Kaido and seemingly moved on with Ferran, the internet didn’t just react…

End of content

No more pages to load