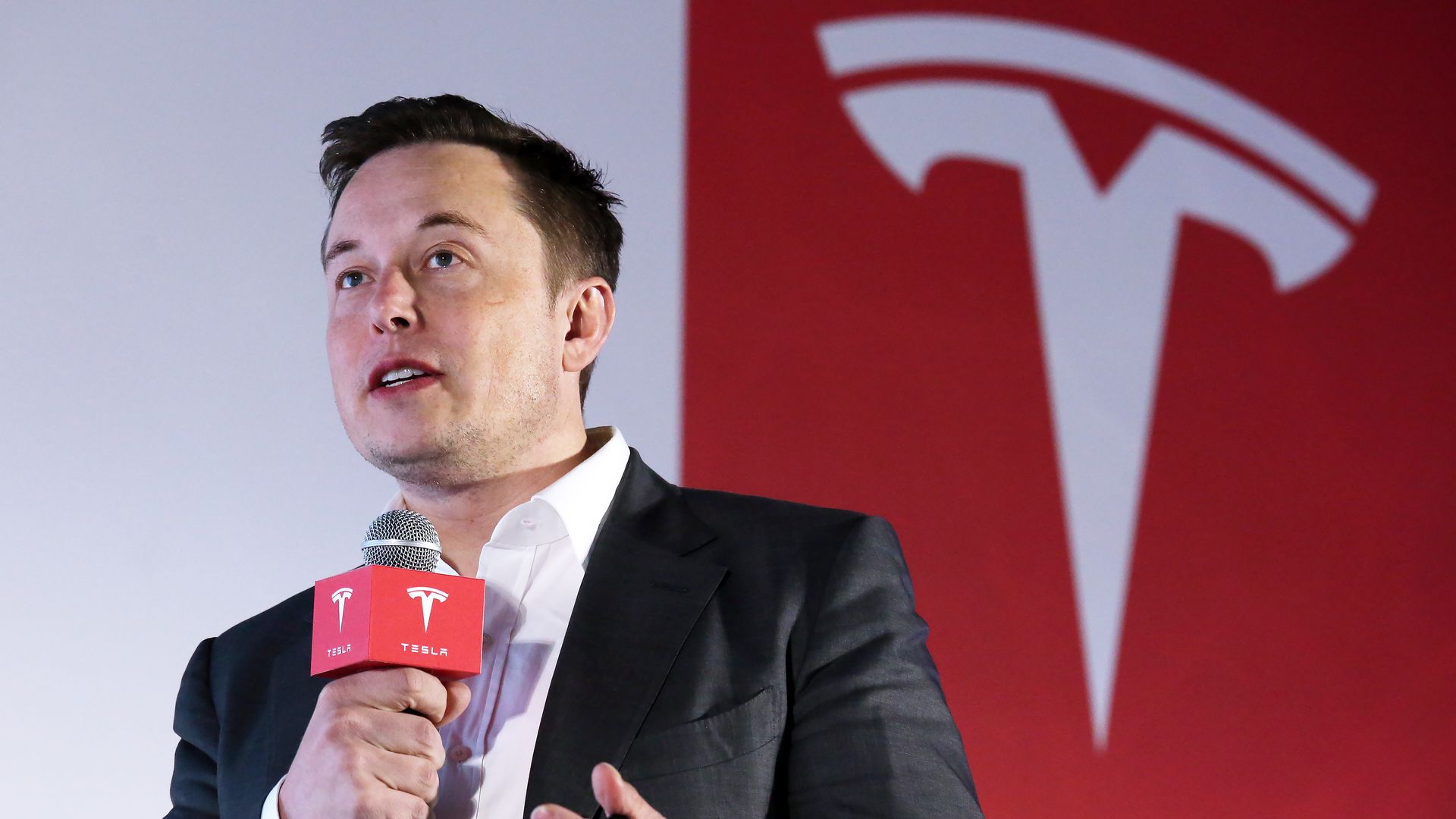

Tesla CEO Elon Musk has once again turned up the heat on Wall Street, issuing a stark warning to investors betting against the company: If they don’t exit their short position before Tesla reaches autonomy at scale, they will be obliterated.” What does this mean—and could it indeed trigger a lasting short squeeze? Let’s dig in.

:max_bytes(150000):strip_icc():focal(749x0:751x2)/elon-musk-tesla-080425-ccb15754843b414cb59af2e285472ef0.jpg)

The Warning that Shook the Market

In mid-August, Musk fired off a blunt message in response to a retail investor’s X post naming major short holders, including MUFG Securities, Jane Street, and Citadel Advisors. With short interest at about 2.6% of Tesla’s float—equivalent to roughly 72 million shares valued at over$24 billion—Musk didn’t mince words: stay in or be obliterated

Benzinga reported that Musk’s message wasn’t idle theatrics: robotaxi rollouts, improvements in Autopilot, and the soon-to-follow Optimus robot form Musk’s roadmap to achieving large-scale autonomy. If delivered, these developments could radically elevate Tesla’s valuation.

Track Record of Threats and Burn Promises

This isn’t Musk’s first showdown with short sellers:

2018: Musk warned shorts of an imminent “short burn of the century,” suggesting that deliverables like hitting Model 3 production targets would spark a squeeze.

2024: He even threw shade at Bill Gates, suggesting anyone shorting Tesla after Autonomy and Optimus launch would face financial ruin—Even Gates.”

The rhetoric is consistent: Musk sees autonomy as the line in the sand. Once Tesla crosses it, he believes the consequences for short sellers will be devastating.

Where Tesla Stands on Autonomy—and the Timeline

So how close is Tesla to achieving autonomy at scale?

According to recent earnings calls, the company expects some rough quarters ahead—especially after the sunset of U.S. EV tax incentives. Yet, Musk remains bullish, targeting autonomy to contribute meaningfully by late 2026. Robotaxi services are already operating in pilot modes in Austin and regions around the Bay Area.

Electrek, however, cautions: short interest is low, and even a significant rally wouldn’t necessarily induce a classic “short squeeze.” Musk’s deadlines have repeatedly slipped, and macro pressures—tax credit loss, rising competition, slowing growth—delay the payoff.

Tensions Behind the Scenes

Adding another layer, Tesla’s Senior VP Tom Zhu recently sold over 82% of his shares between 2023 and 2024—between $174 to $323 per share. This exec-level exodus sparked fresh concerns around insider confidence. Musk responded not with reassurance, but another jolt to short sellers: they stand to be obliterated” once autonomy arrives.

Simultaneously, Musk admitted that activist investors might try to oust him from Tesla’s leadership, pointing to instability at the top.

Could the Warning Ignite a Short Squeeze?

Let’s assess the likelihood:

That said, if Tesla does deliver on autonomy—robotaxis, Optimus, self-driving fleet—the stock could skyrocket, embroiling shorts in steep losses. It’s less about a guaranteed short burn and more about high-stakes poker.

Bottom Line: Musk’s Warning, Reality and Risk

Elon Musk’s latest salvo—“shorts will be obliterated”—is powerful theater with teeth. It reflects his enduring defiance of short-sellers and underscores his confidence in autonomy as Tesla’s future.

But several bullets stand between hype and reality:

Musk’s timeline remains aspirational.

Tesla’s short float is limited.

External pressures are mounting.

Insider behavior raises questions.

Still, the mere threat is enough to stir the market—particularly among smaller investors and analysts closely watching Tesla’s next moves.

News

New Colossus: The World’s Largest AI Datacenter Isn’t What It Seems

In a quiet corner of the American Midwest, a sprawling facility has been generating whispers among tech insiders, policy analysts,…

Kayleigh McEnany: This is Sending the World a Message

Kayleigh McEnany, former White House Press Secretary and political commentator, has long been recognized for her unflinching communication style and…

Candace Says Thiel, Musk, Altman NOT HUMAN

In a statement that has sparked widespread discussion across social media and news platforms, conservative commentator Candace Owens recently claimed…

Judge Pirro Reveals HARDEST Part of Job as US Attorney

Judge Jeanine Pirro is a household name in American media and law, known for her sharp wit, commanding presence, and…

Harris Faulkner: This Could Potentially EXPLODE

In the constantly shifting landscape of American media, few figures have sparked as much debate, admiration, and scrutiny as Harris…

Kaido is CRASHING OUT After Salish DUMPS Him For Ferran (Nobody Saw This Coming)

When word broke that Salish Matter had dumped Kaido and seemingly moved on with Ferran, the internet didn’t just react…

End of content

No more pages to load