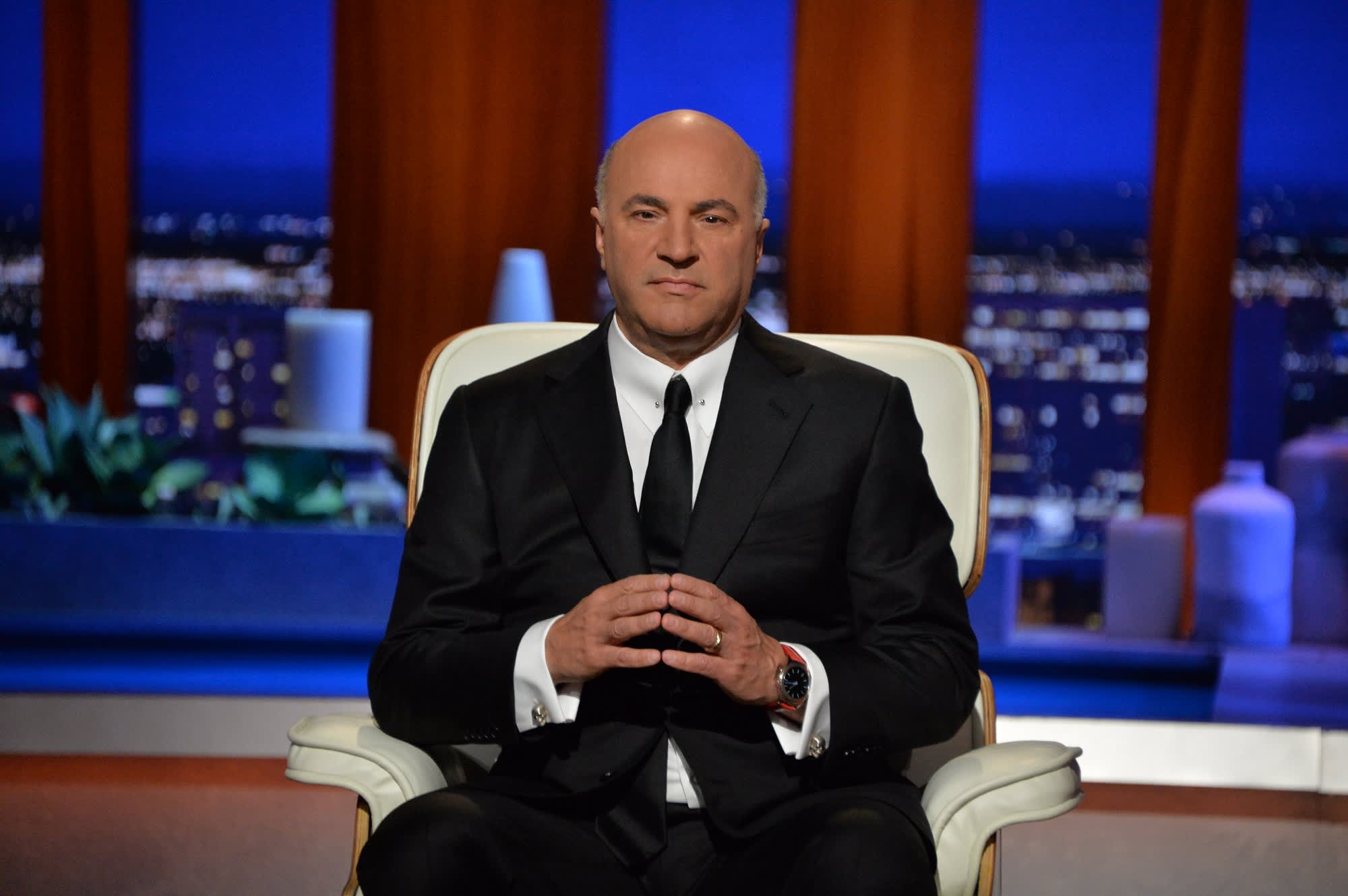

Kevin O’Leary — entrepreneur, investor, TV personality, and oftentimes provocateur — has recently landed the spotlight again with a dramatic declaration about New York City. In the wake of aggressive legal rulings against Donald Trump in New York, O’Leary has publicly warned he will not back down, and has made bold statements about pulling investments from the city and doubling down on criticism of its political and judicial environment. His comments, which some are calling a “bombshell,” raise deeper questions about real estate, rule of law, business confidence, and political theater.

This article delves into what O’Leary is saying, what evidence supports (or contradicts) his claims, the reactions he’s drawing, and what broader implications his bombshell might carry for New York — and perhaps beyond.

The Context: New York Ruling, Business Climate, and O’Leary’s Position

The stage for O’Leary’s recent eruption is Judge Arthur Engoron’s ruling in New York’s civil case against Donald Trump. In that decision, Trump was ordered to pay roughly $355 million in damages and was barred from conducting business in New York State for three years. The ruling has sent ripples through legal, political, and financial communities.

O’Leary responded bluntly: he called the ruling irrational and arbitrary, and declared that he would never invest in New York now. He argued that the decision signals a broader dedollarization of trust in the city as a safe jurisdiction for capital. Trump, in turn, praised O’Leary for his stance, framing the conflict as part of a broader struggle between business freedom and judicial overreach.

kIn this heated environment, the “bombshell” is O’Leary’s explicit statement that he’s not stepping back — even as others might. He is not quitting the fight. He is refusing to yield. And he is threatening material consequences: withdrawal of future investment, avoidance of new projects, and amplification of negative narratives about New York.

What O’Leary Is Saying: Lines, Warnings, and Stakes

At the core of O’Leary’s messaging are several recurring themes. Below is a breakdown of his key claims and rhetorical thrusts:

I would NEVER invest in New York now.”O’Leary frames this as a moral and economic stand — one that he says many investors already feel, but perhaps lack the voice to say. He refers to large-scale projects — e.g. a $4 billion data center — that he says he would not risk in that jurisdiction.

They’ve made it uninvestable.”O’Leary emphasizes that between high taxes, regulatory overreach, judicial unpredictability, and political instability, New York has become hostile to capital. He points to past experiences: projects that shifted elsewhere because local policy or courts made business untenable.

Disdain for judicial overreach & arbitrary rulings.An underlying accusation is that Judge Engoron’s decision was politically motivated, legally unsound, or beyond the proper scope of judicial power. O’Leary repeatedly questions “where is the victim?” and regards such rulings as alarming precedents.

Refusal to be silenced or sidelined.By stating “he’s not dropping out,” O’Leary signals that he views this as not just a moment of critique but a turning point. He intends to press forward, speak louder, and make withdrawal from business engagements a signal of protest.

Broadening the critique beyond Trump.O’Leary frames New York’s crisis as systemic rather than partisan. He doesn’t cast blame solely on one figure but sees the city’s policy, judiciary, and tax structure as collectively driving capital flight.

p>

Evidence & Reality Checks: How Much Is Rhetoric vs. Backed Risk?

While O’Leary’s declarations are bold, scrutiny demands probing where they rest on solid ground and where they may overreach. Here’s an evidence-based assessment:

Supporting Evidence & Historical Backdrop

Capital flight from New York: It is well documented that high earners, companies, and real estate investors have relocated from New York — or considered doing so — citing taxation, cost of living, regulatory burdens, and infrastructure deterioration. (This is affirmed in various reports on migration and tax base shifts.)

Project relocation anecdotes: O’Leary himself describes one project: a data center originally intended for upstate New York that, due to regulatory or political pressure, was moved to Norway. That anecdote lends weight to claims of business friction in New York’s environment.

Momentum in similar business critiques: Others in finance and real estate have voiced similar frustrations: that New York’s tax rates, rent mandates, labor rules, and litigation climate have undermined its competitiveness.

rongPolicy and court unpredictability: In high-stakes cases, attorneys and business people sometimes cite unpredictability in New York courts, inconsistent rulings, and judicial activism as deterrents to investment.

Challenges & Counterpoints

Possibility vs. action: Declaring you won’t invest is different from actually divesting or pulling projects already planned. The latter invites legal, contractual, financial, and reputational costs. O’Leary has not (publicly) laid out specific projects he is canceling or moving.

Survivorship bias: Many businesses succeed in New York despite high costs and regulatory hurdles. Capital-intensive projects continue to launch there (e.g., tech, real estate, finance). The fact that some leave does not necessarily prove system collapse.

Political splash vs. sustainable position: O’Leary’s background as a media figure (e.g. “Shark Tank”) and his frequent commentary suggests he is well-practiced at generating headlines. Some of his rhetoric may amplify risk to drive media attention, rather than signal exclusive shifts in strategy.

Legal & contractual constraints: Some investments are already committed (leases, debt, stakeholder obligations). Backing out could trigger penalties, lawsuits, or reputational damage.

Differentiated zones: The investment environment is not uniform — commercial, residential, industrial, tax districts, boroughs, and infrastructure zones differ. Blanket statements risk oversimplification.

Reactions, Backlash & Stakes for New York

O’Leary’s bombshell has stirred reactions from political, business, and civic quarters. Some key responses and risks include:

Political pushback: Proponents of New York governance have defended the ruling as necessary accountability. They argue that wealthy actors threatening to withdraw investments—especially in reactionary posture—should not dictate legal outcomes.

Amplification in debates: O’Leary’s voice reinforces narratives of New York in decline. Opponents of his position warn that such declinism can become self-fulfilling prophecy: if investors believe the city is failing, they may exit en masse, making the downfall material.

Influence on other investors: If other business leaders echo O’Leary’s stance, it may trigger capital reallocation to more investor-friendly states (Texas, Florida, etc.). That would further erode New York’s competitive edge.

Local economic fallout: Withdrawal of new capital can slow job growth, reduce tax revenue, and exacerbate budget pressures — especially if perceived exodus is large-scale.

Brand & reputation damage: New York’s identity as a finance and innovation hub may be challenged. If prominent names declare the city unworthy of investment, it may discourage startups, talent, and industries from locating there.

Possible Scenarios & What Comes Next

Given where things now stand, a few trajectories seem likely — and worth watching.

Incremental Retrenchment

O’Leary — and perhaps others — gradually shift future projects away from New York, citing policy risk, but maintain existing investments (unless contracts compel exit).

Public posturing becomes a negotiating tactic: threat of capital withdrawal to push for tax reform or regulatory relief.

Public Showdowns & Legal Moves

O’Leary or others might terminate or relocate announced projects, and make lawsuits or public claims about lost opportunity costs.

New York officials could respond with incentives, regulatory countermeasures, or political attacks on “capital flight elites.”

Business Mobilization & Amplification

More business leaders publicly affirm reluctance to invest in New York, turning O’Leary’s comment into a movement: “No new capital until judicial reform.”

Alternative hubs (midwest, southern states) may advertise aggressively to lure capital leaving New York.

Reversal or Retraction

If political, legal, or reputational pressure mounts, O’Leary may soften his tone, reinvest selectively, or frame his remarks as dramatic rather than literal.

New York could respond with reforms — tax cuts, regulatory streamlining, investor protection enhancements — to try to counteract negative momentum.

Why This Bombshell Matters: Beyond Headlines

What makes O’Leary’s statement more than just another loud business commentary is how it touches deep currents in American economic life:

Signal vs. noise: When high-profile capital players threaten withdrawal, it’s not just about money — it signals perceptions of risk, life expectancy of economic models, and confidence in institutions.

Judiciary & investor balance: O’Leary’s critique frames courts not merely as arbiters but as actors in economic ecosystems. When judicial decisions are contested as “too political,” it raises questions about separation of powers and investor protections.

Capital mobility & jurisdictional competition: In a more global, mobile economy, capital moves where policies and governance invite it. Cities become battlegrounds for policy credibility.

Identity & narrative battle: New York’s brand is under pressure. If narratives of decline dominate, they may reshape migration, development, and media narratives for years.

Precedent for other states: If New York loses ground, it may embolden investors to reevaluate other jurisdictions perceived as hostile — expanding the pressure for fiscal, regulatory, or judicial reform nationwide.

Conclusion: The Bombshell Echo and the Long Game

Kevin O’Leary’s declaration — that he’snot dropping out, that he will no longer invest in New York, and that the city has made itself uninvestable — is more than rhetorical thunder. It is a challenge, a warning, and a potential turning point in how business, law, and politics intersect in America’s iconic metropolis.

Whether his bombshell is a harbinger of actual capital flight, or more performative positioning, remains to be seen. But already it forces a reckoning: Is New York willing to adapt, defend its institutions, and restore confidence — or will its decline be narrated into existence?

As capital clinks and echoes, the question is: will New York answer the warning — or let the silence answer for it?

News

New Colossus: The World’s Largest AI Datacenter Isn’t What It Seems

In a quiet corner of the American Midwest, a sprawling facility has been generating whispers among tech insiders, policy analysts,…

Kayleigh McEnany: This is Sending the World a Message

Kayleigh McEnany, former White House Press Secretary and political commentator, has long been recognized for her unflinching communication style and…

Candace Says Thiel, Musk, Altman NOT HUMAN

In a statement that has sparked widespread discussion across social media and news platforms, conservative commentator Candace Owens recently claimed…

Judge Pirro Reveals HARDEST Part of Job as US Attorney

Judge Jeanine Pirro is a household name in American media and law, known for her sharp wit, commanding presence, and…

Harris Faulkner: This Could Potentially EXPLODE

In the constantly shifting landscape of American media, few figures have sparked as much debate, admiration, and scrutiny as Harris…

Kaido is CRASHING OUT After Salish DUMPS Him For Ferran (Nobody Saw This Coming)

When word broke that Salish Matter had dumped Kaido and seemingly moved on with Ferran, the internet didn’t just react…

End of content

No more pages to load