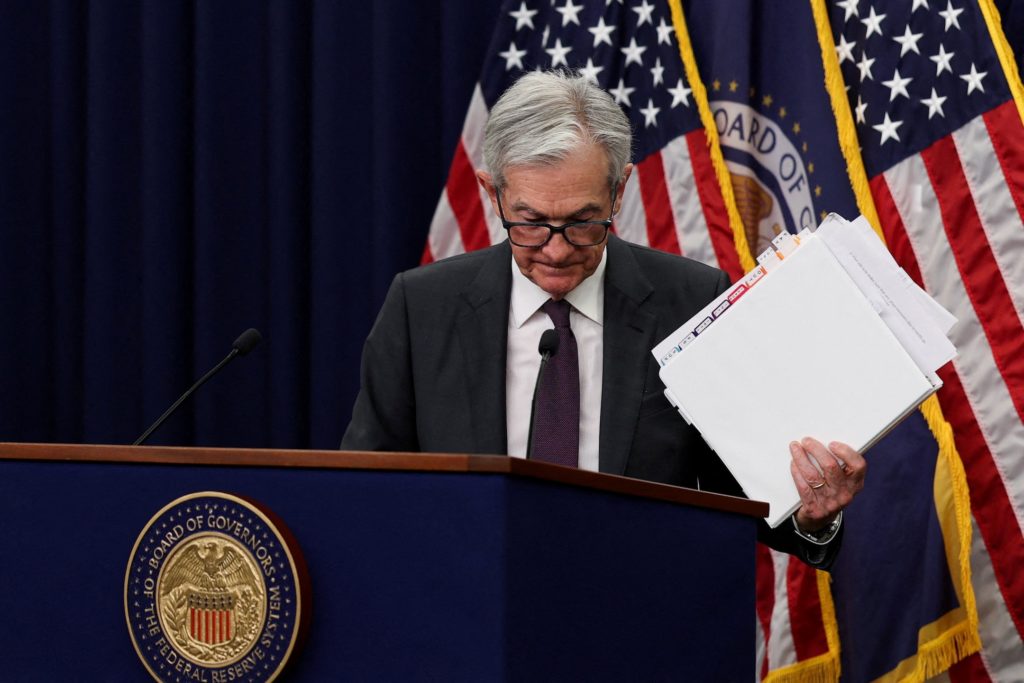

In October 2025, Federal Reserve Chair Jerome Powell delivered a message that caught the attention of economists, policymakers, and markets alike: the U.S. labor market is weakening more than the headline numbers suggest, and downside risks to employment are rising. His remarks raise the question: how much of the slowdown is already baked in, how much is hidden, and what might lie ahead for the broader economy?

The Warning: What Did Powell Actually Say?

During a speech at a National Association for Business Economics event in Philadelphia, Powell cautioned that recent data may understate labor weakness. He remarked that “further declines in job openings might very well start to show up in unemployment” if the trend persists. He also noted that changes in immigration had been stronger than expected, which could be contributing to labor supply and demand shifts.

Much of his tone emphasized a growing divergence: while some economic activity remains stable, hiring and firing are both muted—a state sometimes called “no-hire, no-fire.” Powell has also said that this “less dynamic and somewhat softer labor market” elevates downside risks to employment.

In earlier remarks, Powell admitted that the recent Fed rate cut was in part driven by labor market weakness, saying that downside risks to employment may now dominate upside risks to inflation. He described the current policy stance as “modestly restrictive,” but flexible enough to respond to worsening conditions if needed.

In short: Powell is flagging that things may be worse than they appear—and that the Fed is watching closely.

The Evidence: Why Many Economists See Powell’s Warning as Credible

Powell’s message resonates with several underlying data signals and structural shifts. Below are the key signs.

Sluggish Hiring & Weak Job Openings

In recent months, job additions have slowed dramatically. Data revisions over the prior year have removed hundreds of thousands of previously counted jobs, suggesting that earlier strength was overstated. Meanwhile, the gap between job openings and unemployed workers has narrowed, hinting at slack in demand.

Powell’s concern is that if openings keep falling, layoffs might rise, pushing unemployment higher.

Revisions That Changed the Narrative

Perhaps most striking was the benchmark revision that trimmed nearly 911,000 jobs from previously reported figures for the 12 months ending March 2025. This adjustment dramatically reshapes the picture of recent labor strength and gives weight to the idea that earlier reports were overly optimistic.

Muted Layoffs — But Frozen Hiring

Even though layoffs remain subdued, hiring is also weak. Reports suggest many firms are choosing to hold steady rather than expand or contract, creating a flatline labor environment. That pattern is worrisome: if no new positions are created, growth stalls.

External and Structural Headwinds

Powell has flagged certain structural challenges—notably more restrictive immigration policies and demographic shifts—as contributing to labor force constraints. At the same time, tariff pressures and supply chain strains are generating cost pressures that may be squeezing hiring decisions.

Add to that the uncertainty created by the government shutdown, which has disrupted some official reporting. Powell noted that while the outlook for employment and inflation hasn’t shifted dramatically since September, the lack of full data complicates assessments.

In sum, multiple lines of evidence support Powell’s caution that the true fragility in the labor market may be deeper than casual readings suggest.

Risks and Implications: What Could Get Worse

If Powell is correct, several major risks to the economy could amplify.

Rising Unemployment

A continuation of the current trend—falling openings, cautious hiring—could lead to more layoffs and rising unemployment. Given the lag between hiring decisions and actual unemployment, the full effect may yet lie ahead.

Stagnant or “Jobless Growth”

One feared scenario is “jobless growth”—GDP may hold up for a time, buoyed by consumption or investment, while employment lags behind or even declines. Goldman Sachs has recently warned of this possibility as technology and productivity gains outpace labor absorption.

Policy Dilemma for the Fed

Powell and the Fed confront a classic dilemma: inflation is still above target (~2.9% on a preferred measure) , but with employment risks rising, accommodative policy may be needed. Powell has repeatedly emphasized the challenge of balancing both sides of the Fed’s dual mandate.

Markets currently expect the Fed to cut rates twice more in 2025. But if inflation surprises or weakening labor trends worsen, the Fed may be forced to slow, pause, or even reverse course.

Confidence, Sentiment, and Investment

If business leaders begin to interpret Powell’s warning as sign of deeper troubles, investment could contract further. Anyone making hiring or capital decisions may hold off, creating a self‑fulfilling slowdown.

Political Fallout

As weakness in employment becomes more visible, political pressures may intensify. Lawmakers might push the Fed to act more forcefully, while critics may fault the administration for lack of growth. The interplay between monetary policy and political expectations will become more fraught.

Counterarguments & Caveats: Why the Slowdown Might Not Be as Severe

Despite the warning signs, several caveats suggest the situation may not deteriorate catastrophically.

Strong Micro Pockets & Resilience

Some sectors continue hiring actively (e.g. healthcare, technology, services), which may cushion the blow. Localized strength could stabilize national data.

Lag in Data & Recoverability

Employment is a lagging indicator. Sometimes slower hiring only reflects caution in firms waiting for clarity. If macro conditions improve, hiring may rebound.

Inflation Risk Still Real

If inflation rebounds or remains sticky, the Fed might be forced to hold off on cuts, even in the face of labor weakness. Powell has warned about upside risks to inflation and the need to guard expectations.

Role of Revisions and Technicalities

Some of the negative signals come from statistical revisions and technical definitions (e.g. how job openings are measured). These might overstate deterioration in the short term.

Delayed Policy Reaction

The Fed has emphasized a data‑driven, meeting‑by‑meeting approach, resisting overcommitment to cuts.This cautious path may preserve flexibility—and avoid policy mistakes—if conditions shift.

What to Watch: Key Indicators in the Coming Months

To assess whether Powell’s warning unfolds, observers should monitor:

Weekly jobless claims: early signal of rising unemployment

Nonfarm payrolls & unemployment rate: to see if hiring slows and unemployment moves up

Job openings / quits rates: continuing declines would suggest labor demand erosion

Wage growth & compensation trends: as a check on whether labor squeeze remains

Consumer spending / retail & services activity: to see if demand softens

Inflation measures (core PCE, CPI excluding food/energy): to gauge Fed’s room to cut

Fed statements & minutes: to track shifting policy tone

Business sentiment / investment plans: to spot risk of feedback loops

If many of these indicators move in tandem downward, the labor market may reveal more damage than current reports show.

Conclusion: The True Challenge Is in the Unknown

Powell’s somber tone reflects an awareness that headline statistics can be misleading—and that the labor market may be under more strain than perceived. The major question is whether the hidden deterioration will manifest in rising unemployment, weaker growth, or policy missteps in coming quarters.

While strong sectors and policy flexibility offer some buffer, the risk of a sharper slowdown is real. If Powell is right, markets and policymakers may only now be seeing the tip of a labor iceberg. For now, the safest assumption is that the challenge ahead is not to be underestimated

News

New Colossus: The World’s Largest AI Datacenter Isn’t What It Seems

In a quiet corner of the American Midwest, a sprawling facility has been generating whispers among tech insiders, policy analysts,…

Kayleigh McEnany: This is Sending the World a Message

Kayleigh McEnany, former White House Press Secretary and political commentator, has long been recognized for her unflinching communication style and…

Candace Says Thiel, Musk, Altman NOT HUMAN

In a statement that has sparked widespread discussion across social media and news platforms, conservative commentator Candace Owens recently claimed…

Judge Pirro Reveals HARDEST Part of Job as US Attorney

Judge Jeanine Pirro is a household name in American media and law, known for her sharp wit, commanding presence, and…

Harris Faulkner: This Could Potentially EXPLODE

In the constantly shifting landscape of American media, few figures have sparked as much debate, admiration, and scrutiny as Harris…

Kaido is CRASHING OUT After Salish DUMPS Him For Ferran (Nobody Saw This Coming)

When word broke that Salish Matter had dumped Kaido and seemingly moved on with Ferran, the internet didn’t just react…

End of content

No more pages to load