In October 2025, Nvidia CEO Jensen Huang made headlines with a revealing statement about Elon Musk and his AI ventures. During an interview with CNBC, Huang expressed both admiration and regret: admiration for the ambition of Musk’s companies and regret for not having invested more in one of them, xAI. The most striking line:Almost everything that Elon’s part of, you really want to be part of as well.”

)

This article digs into what Huang’s remark means—financially, strategically, and symbolically. We’ll parse the business and tech landscape underlying the statement, examine what Nvidia’s investments in Musk’s projects (especially xAI) look like, and consider what this signals for competition, collaboration, and risk in the accelerating AI sector.

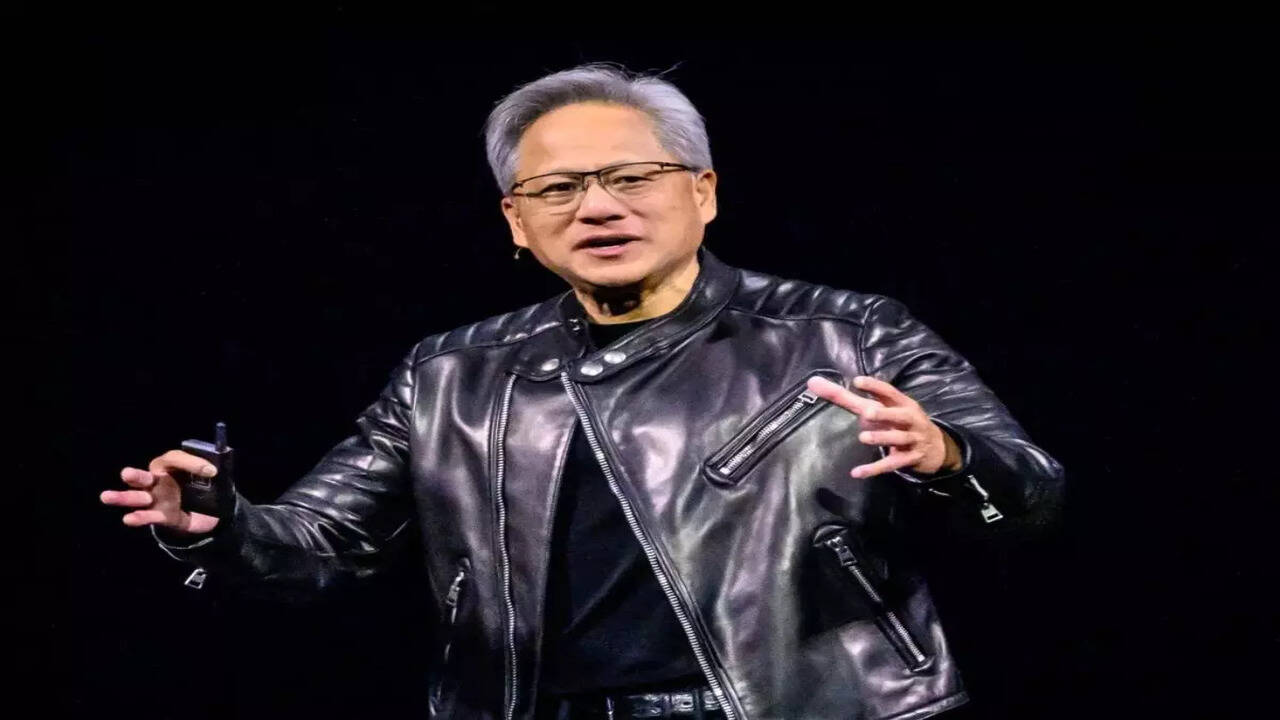

What Huang Actually Said

Here are the key points from Huang’s comments, drawn from multiple sources:

Huang said he and Nvidia are already investors in Elon Musk’s AI startupxAI, but he regrets that Nvidia did not contribute more in the latest funding round.

He emphasized that Musk tends to build transformative companies — e.g., Tesla, SpaceX — and that when someone of Musk’s track record launches something ambitious in AI or adjacent fields, Nvidia wants to be involved.

Huang said: “Almost everything that Elon is part of, you really want to be part of as well.”

Regarding xAI’s funding, Huang clarified that Nvidia’s participation in financing is more than just supplying GPUs; it involves equity investment, though he positioned it as part of a broader interest in AI infrastructure and partnerships.

These statements suggest not just passivity but a proactive positioning: Nvidia is looking outward, scanning what Musk is doing, wanting in, and willing to invest.

Why It Matters: Strategic Implications

Huang’s comments are not just flattering — they carry serious strategic import. Here are several dimensions in which this stance could influence the industry.

Investment & Financial Exposure

Nvidia participating heavily in xAI means both risk and reward. xAI is currently raising large sums — some reports estimate a ~$20 billion round, with Nvidia contributing significant equity.

By investing, Nvidia gains potential upside if xAI succeeds, especially as demand for AI computing, large‑language models, and infrastructure continues to surge. But there are risks: competitive threat, regulatory issues, cost overrun, or failure of the underlying product/market.

Technology & Infrastructure Dependencies

Nvidia makes chips (GPUs) and supplies hardware that many AI companies — including Musk’s — depend on. Huang’s interest in “being part of everything” Musk is involved in partly reflects this hardware nexus: if Musk’s companies need Nvidia hardware, Nvidia has leverage, but also exposure if supply‑chain, manufacturing, or policy risks intervene.

Also, being an investor helps Nvidia influence or at least monitor upstream demand, possibly securing priority access to its own hardware, better terms, or smoother relationships.

Competitive or Cooperative Dynamics

Musk and Nvidia are not always purely in cooperation. Tesla has its own AI ambitions (do‑it‑in‑house software and hardware), xAI is a competitor of other AI firms that Nvidia also backs, and there is reportedly “circular financing” concerns, where Nvidia invests dollars that ultimately come back as purchases of its own hardware. Huang sought to distinguish their equity investments from simple vendor financing.

Thus, Huang walking this line means managing competitive risk — ensuring that being involved doesn’t also mean being undercut or exposed by Moss’s rivalries or regulatory scrutiny.

Reputation & Credibility

Musk is seen by many in tech as a visionary, though also polarizing. By aligning publicly (via investment and praise) with Musk’s ventures, Huang benefits from the prestige and attention that come with association. But there is also the risk that Musk’s controversies, regulatory or social, bounce off Nvidia, particularly if public opinion or regulation turns against aspects of Musk’s work.

Huang’s statement is part of a branding strategy: positioning Nvidia not merely as a chip‑maker, but as part of the core story of generative AI leadership.

What We Do Know: Nvidia’s Involvement with xAI & Other Musk Ventures

Here are facts and developments that substantiate Huang’s claim:

Equity Investment in xAINvidia is already an investor in Musk’s xAI, but Huang wishes the investment had been largerxAI’s Major Funding RoundxAI is reportedly raising ~$20 billion, combining equity and debt. In that funding round, Nvidia may be contributing up to $2 billion in equity.

GPU Supply DealsSome of the funding is tied to acquisition of Nvidia GPUs. The structure involves partnerships where xAI may rent GPUs via special purpose vehicles, or partner for priority supply.

Praise for Musk’s Engineering DirectionHuang has repeatedly praised Musk’s engineering efforts — for example, calling the construction of a supercomputer in Memphis in 19 days “superhuman.”

These points show that Huang’s statement has grounding: Nvidia is materially involved with Musk’s AI ambitions, both through capital and hardware, and sees Musk’s efforts as significant opportunities rather than just competition.

What We DON’T (Yet) Know

Even while the above is clear, there are areas of uncertainty that make Huang’s statement more nuanced than a headline soundbite.

Exact terms and equity share: While Nvidia is contributing to xAI’s funding, the exact stake, contractual obligations, or influence (board seats, rights) aren’t fully public in detail.

How “being part of everything” would scale: It is one thing to invest in xAI; to fully participate in all Musk’s ventures (Tesla, SpaceX, Neuralink, Optimus, etc.) would involve large capital, technical exposure, risk, and perhaps also regulatory oversight. It’s not yet clear whether Nvidia intends or can commit to that scale.

Risk management: We do not fully know how Nvidia is balancing exposure versus independence. For example, what happens if Musk’s business faces regulatory or political headwinds? NVIDIA’s brand and operations could be impacted.

Competition vs. dependency: Some of Musk’s ventures seek to build technology themselves (e.g. Tesla building its own AI chips), which could reduce dependency on Nvidia. How Huang views that risk is not fully spelled out in his public comments.

Potential Risks & Challenges

With big opportunity comes big risk. Below are some of the challenges Nvidia may face by wanting to be “part of almost everything” Musk is involved in.

Regulatory scrutinyAs AI becomes more regulated (on safety, data privacy, labor, etc.), being financially or technologically entwined with many high‑visibility Musk projects may draw stronger government oversight.

Conflict of interest and competitive threatsMusk’s companies compete in some areas (e.g. self‑driving, AI assistants). If Nvidia is a supplier, investor, and sometimes competitor, conflicts may arise. For example, Tesla may try to build its own AI chips; how would Nvidia respond?

Supply chain and capacity limitsGPUs and AI hardware are in high demand. Prioritizing for certain partners may strain capacity, causing trade‑offs or delays elsewhere. Nvidia has to manage production, logistics, energy constraints, and geopolitical risks (e.g. component sourcing).

Brand risk & public perception

Musk is controversial in many circles. Aligning too closely could amplify negative perceptions (e.g. environmental concerns, political disagreements, labor issues). Also, failure of Musk‑led projects could reflect back on Nvidia in investor and public eyes.

Valuation risks

If xAI or Musk’s newer ventures underperform or don’t deliver, heavy investment could burden Nvidia with losses or underwhelming returns. Investors will scrutinize whether the returns justify the risks and capital deployed.

Broader Context: The AI Boom & Nvidia’s Position

Huang’s comments make sense when one sees the broader shift in AI and computing:

Demand for powerful GPUs and AI infrastructure is skyrocketing. Nvidia has enjoyed enormous growth as its hardware is core to many large language models, AI training, and inference tasks.

There is a convergence of high ambition in enterprises large and small to invest in AI — with startups, infrastructure players, cloud providers, and even governments pushing forward. Nvidia’s strategy seems to be to remain at the center of this wave.

Musk’s ventures (Tesla, SpaceX, xAI, etc.) are among the highest‑visibility bets being placed on what comes next: autonomous vehicles, AI chat assistants, robotics, the future of communication. By being involved with them, Nvidia aligns itself with what many see as the future frontier.

What This Signals for the Future

Here are some likely scenarios or developments to watch as a result of this willingness to be tied to Musk’s projects:

Closer cooperation on AI hardware and supercomputing

More deals where Nvidia supplies critical components (GPUs, AI systems) to Musk’s companies, possibly under privileged or prioritized terms.

Joint ventures or collaborations

Potential for co‑development agreements: e.g. for robotics (Optimus), autonomous vehicles, or infrastructure. Nvidia might share in R&D or build platforms customized for Musk’s needs.

Competition in overlapping domains

While cooperation can be strong, overlap might spur competition. Nvidia might be pushed to innovate faster to avoid being disrupted if Musk’s companies attempt to build GPU alternatives or custom silicon.

Increased investment risk appetite

Nvidia may allocate more capital into Musk’s ventures or similar high‑risk, high‑reward AI efforts. Investors will watch how that affects earnings, R&D spending, and overall financial stability.

Regulatory & geopolitical considerations

Because Musk and Nvidia operate globally, such deep involvement could attract attention from regulators, trade authorities, or national security agencies concerned about export controls, AI safety, or concentration of power.

Conclusion

Jensen Huang’s remark that he wants to be (almost) everywhere Elon Musk is reflects more than mere admiration. It’s a strategic signal: Nvidia sees Musk’s ventures not only as opportunities to invest in, but as central nodes in the AI‑powered future. Huang is positioning his company to be deeply enmeshed in what many believe is the next wave of technological transformation.

News

New Colossus: The World’s Largest AI Datacenter Isn’t What It Seems

In a quiet corner of the American Midwest, a sprawling facility has been generating whispers among tech insiders, policy analysts,…

Kayleigh McEnany: This is Sending the World a Message

Kayleigh McEnany, former White House Press Secretary and political commentator, has long been recognized for her unflinching communication style and…

Candace Says Thiel, Musk, Altman NOT HUMAN

In a statement that has sparked widespread discussion across social media and news platforms, conservative commentator Candace Owens recently claimed…

Judge Pirro Reveals HARDEST Part of Job as US Attorney

Judge Jeanine Pirro is a household name in American media and law, known for her sharp wit, commanding presence, and…

Harris Faulkner: This Could Potentially EXPLODE

In the constantly shifting landscape of American media, few figures have sparked as much debate, admiration, and scrutiny as Harris…

Kaido is CRASHING OUT After Salish DUMPS Him For Ferran (Nobody Saw This Coming)

When word broke that Salish Matter had dumped Kaido and seemingly moved on with Ferran, the internet didn’t just react…

End of content

No more pages to load