Lead & Context

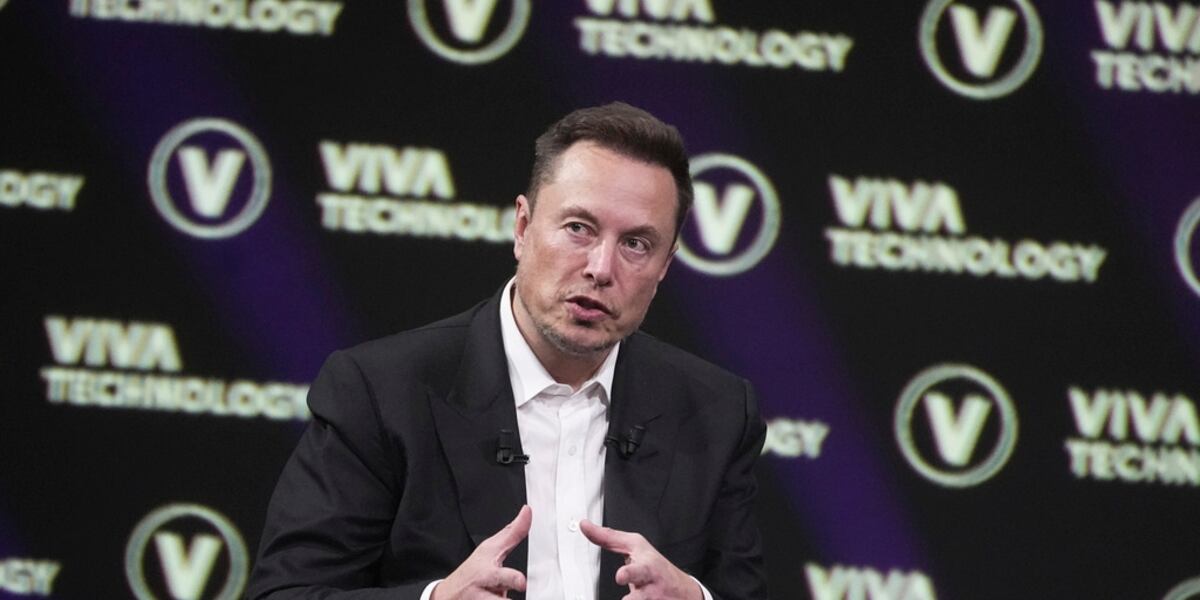

On August 4, 2025, Tesla’s board unanimously approved a restricted stock award of 96 million shares, valued at approximately US $29 billion, as part of a new nterim CEO compensation plan. The move aims tosecure Elon Musk’s leadership through 2027, at a time when the company grapples with strategic shifts, flagging EV sales, and scrutiny over governance

.webp)

This new arrangement follows the legal nullification of Musk’s 2018 performance-based package—originally projected at $56 billion—by a Delaware court, which ruled the approval process procedurally flawed and unfair to shareholders. Musk is appealing the decision before the Delaware Supreme Court

Structure of the Award & Conditions

The 96 million shares will vest over two years, provided Musk remains in a top executive role such as CEO or similar, through 2027. The shares are subject to afive-year holding period, and Musk must pay$23.34 per share—the same exercise price as the 2018 award. If the 2018 package is reinstated, the new award will be forfeited or offset to prevent double-dipping

The grant was approved by a special committee of independent directors, including Robyn Denholm and Kathleen Wilson‑Thompson, who emphasized Musk’s “extensive and wide-ranging” commitments and argued the award is necessary to retain his focus and influence at Tesla

Strategic Rationale: Beyond EVs into AI & Robotics

Tesla’s pivot towardartificial intelligence, humanoid robots, and robotaxis is central to its future strategy. The board highlighted Musk’s leadership as vital to sustaining investor confidence and innovation momentum, particularly amid intensifying competition from China and legacy automakers Given Musk’s involvement in ventures like , and his political engagements, board members argued that aligning his incentives with Tesla’s performance is essential to keep him engaged

Governance Controversies & Calendar Overhang

The 2018 CEO compensation package was voided by Chancellor Kathaleen McCormick, who described it as “an unfathomable sum” and ruled it unfair—emphasizing that Tesla’s board misled shareholders during its approval process. Musk’s appeal of that ruling is ongoing

Governance experts, including Charles Elson of the University of Delaware, criticized the new award as essentially a rebranded version of the struck-down plan, eroding the court’s ruling and raising concerns about board oversight and shareholder protection .

Market & Shareholder Reaction

Tesla’s stock initially jumped nearly 2% on the news, signaling investor relief at eliminating “key person risk” by ensuring Musk’s continued leadership. Notable analysts like Dan Ives of Wedbush Securities noted that the award removes uncertainty and could stabilize the company’s valuation outlook

Yet the stock slid back −0.6% by August 5 amid concerns over weak international EV demand—Germany and the U.K. saw deliveries fall by more than 50%—and Musk’s increasing political distractions

A group of over 20 Tesla shareholders petitioned the company for more transparency, citing declines in profitability and a lack of confidence in leadership direction under Musk’s divided attention

Compensation Philosophy & Broader Implications

Traditional CEO incentive logic ties pay to future performance or earnings goals. In contrast, Musk’s latest award is more about “retention over results”—a rare compensation construct. Critics see it as undermining the original intent of performance-based equity incentives

In effect, Tesla is betting that Musk’s gravitational pull—for hiring top talent and driving innovation—outweighs potential distractions. Still, corporate governance scholars warn this sets a dangerous precedent: massive compensation with minimal measurable deliverables and weak board leverage

Industry watchers question whether such oversized awards, especially when Kyiv‑style oversight has been challenged, could lead to officer entrenchment and erosion of shareholder influence.

Road to Shareholder Approval

Tesla will present a long‑term compensation plan for Musk at its November investor meeting—required under Texas law since its re‑incorporation shift from Delaware. The vote will likely shape future governance expectations and may become a referendum on board conduct and CEO accountability

If shareholders reject this or follow-up proposals, board directors may face pressure to negotiate stricter performance criteria for future awards.

Conclusion: Risk or Reward?

Tesla’s new $29–30 billion award reflects a high-stakes balance: reward a proven, visionary leader to drive innovation—or condone outsized, under‑scrutinized director compensation tied more to retention than performance.

Supporters argue it resolves uncertainty and aligns Musk’s interests with the company for the years ahead. Critics contend the award undermines legal accountability and corporate stewardship—especially given Tesla’s weakening financial performance and Musk’s widening external focus.

As of early August 2025, the legal appeal over the original 2018 package remains unresolved. If Musk prevails, the interim award would be voided. Until then, Tesla is betting big that Musk is irreplaceable—and enough shareholders appear willing to support his continued tenure.

News

New Colossus: The World’s Largest AI Datacenter Isn’t What It Seems

In a quiet corner of the American Midwest, a sprawling facility has been generating whispers among tech insiders, policy analysts,…

Kayleigh McEnany: This is Sending the World a Message

Kayleigh McEnany, former White House Press Secretary and political commentator, has long been recognized for her unflinching communication style and…

Candace Says Thiel, Musk, Altman NOT HUMAN

In a statement that has sparked widespread discussion across social media and news platforms, conservative commentator Candace Owens recently claimed…

Judge Pirro Reveals HARDEST Part of Job as US Attorney

Judge Jeanine Pirro is a household name in American media and law, known for her sharp wit, commanding presence, and…

Harris Faulkner: This Could Potentially EXPLODE

In the constantly shifting landscape of American media, few figures have sparked as much debate, admiration, and scrutiny as Harris…

Kaido is CRASHING OUT After Salish DUMPS Him For Ferran (Nobody Saw This Coming)

When word broke that Salish Matter had dumped Kaido and seemingly moved on with Ferran, the internet didn’t just react…

End of content

No more pages to load