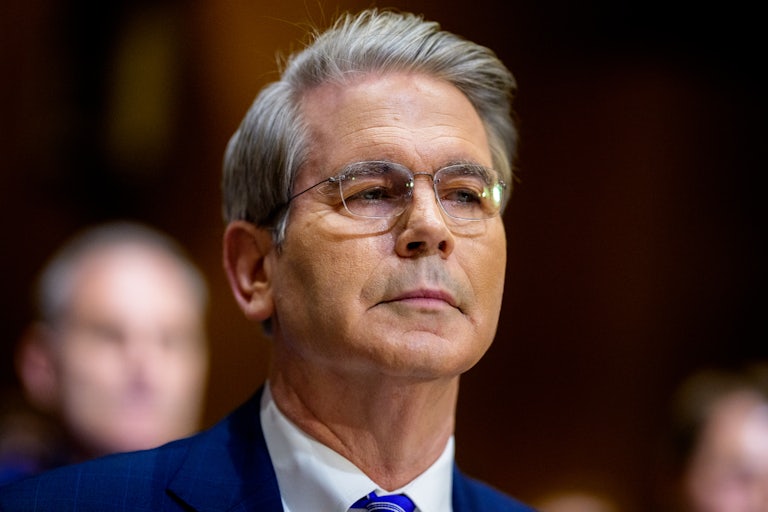

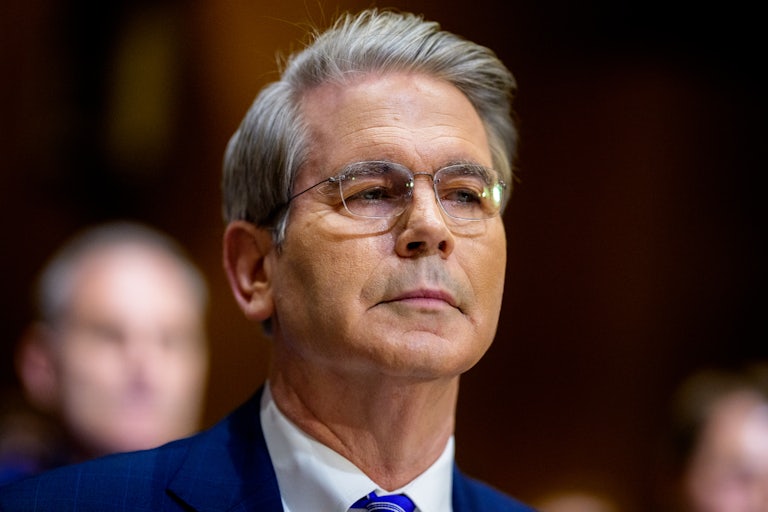

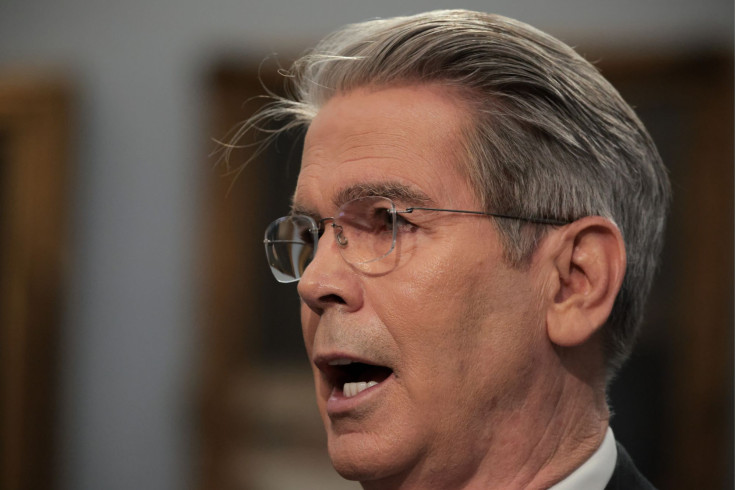

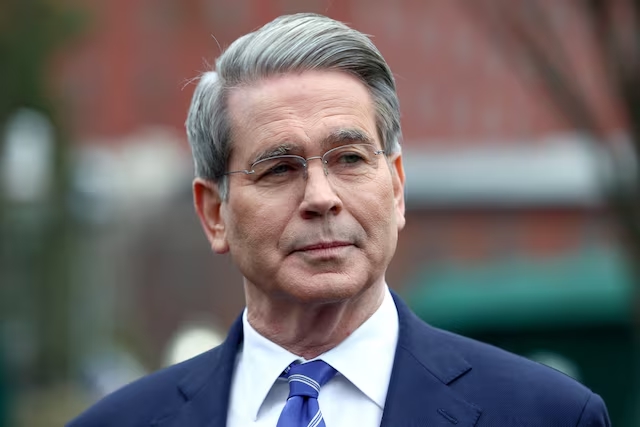

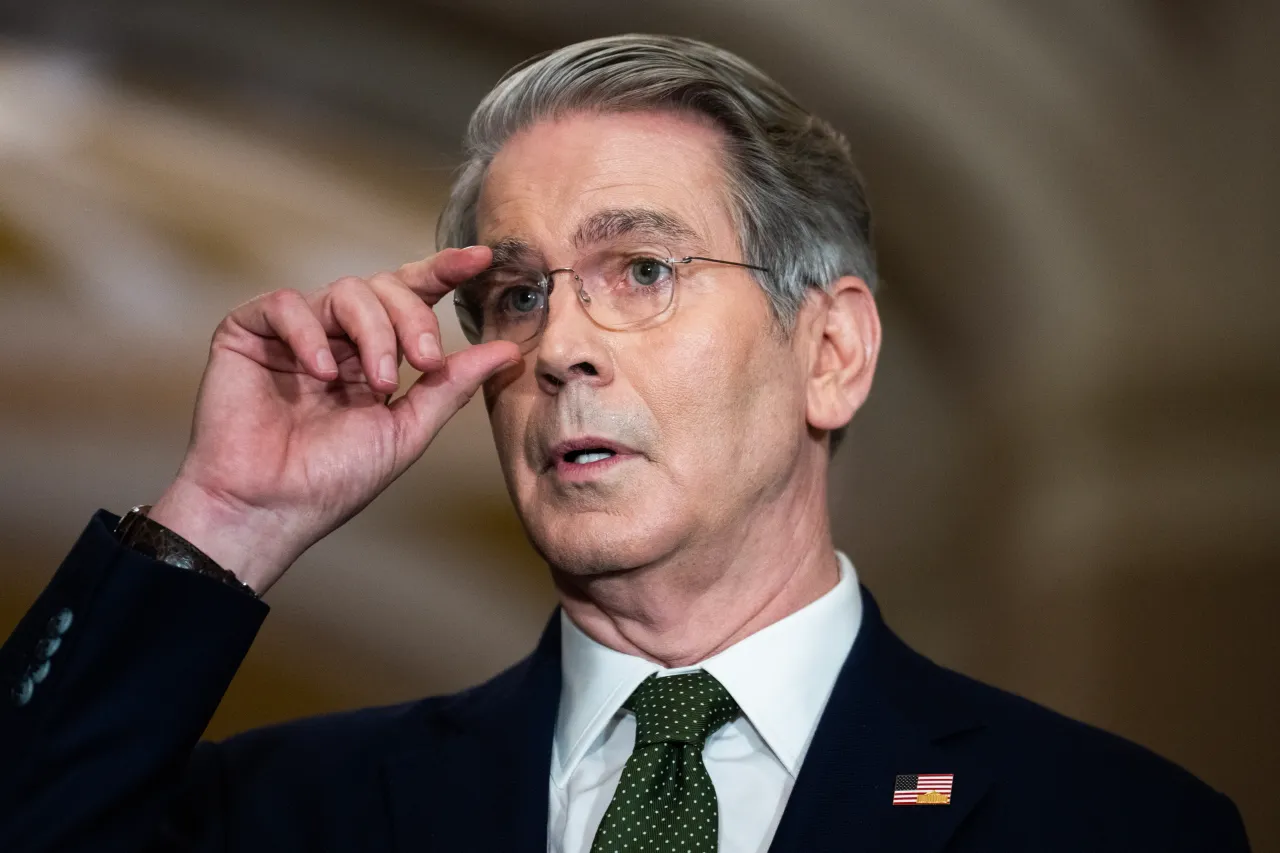

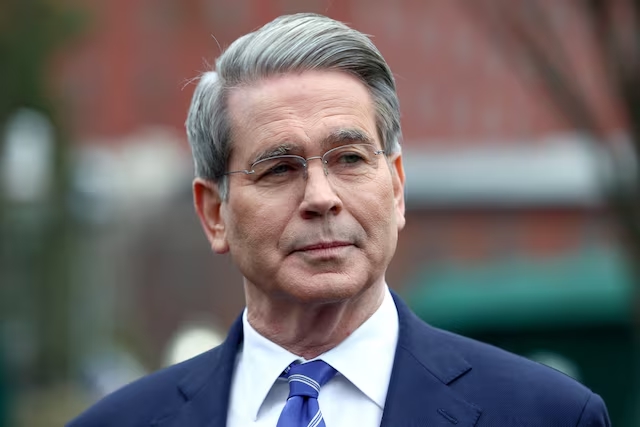

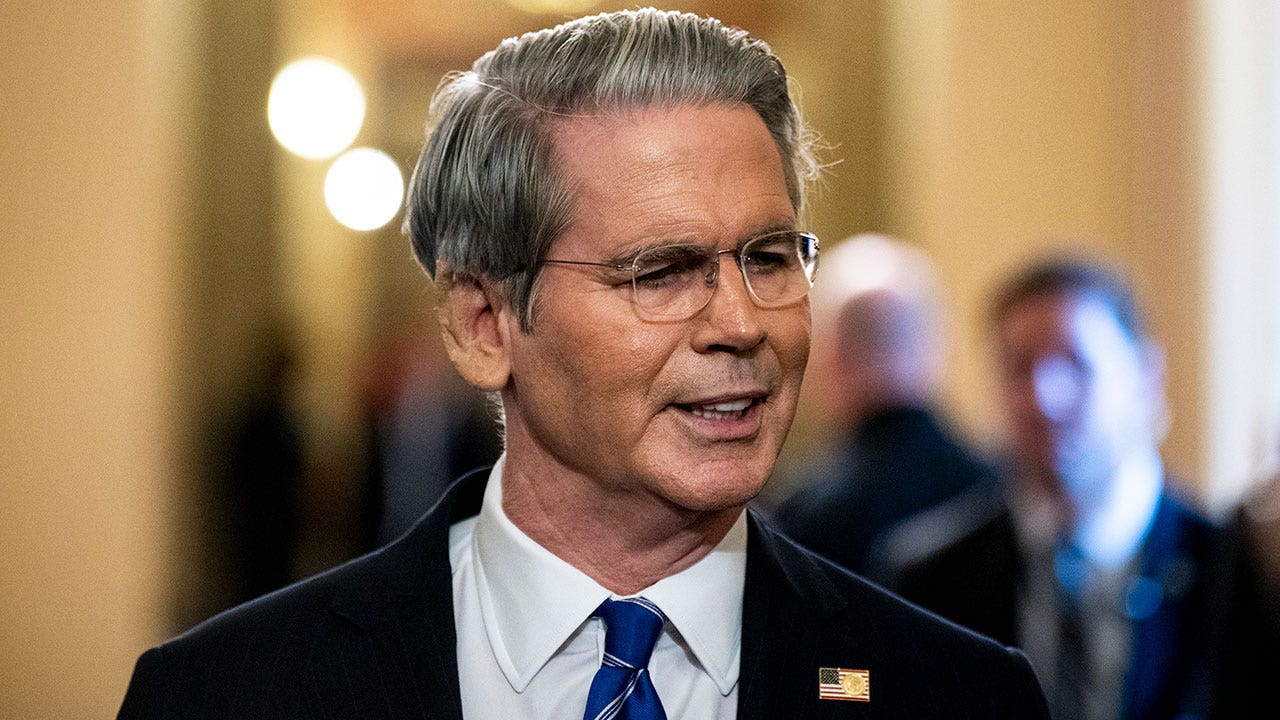

In a strategic pivot that’s reshaping the U.S. economic debate, Treasury Secretary Scott Bessent announced a bold vision for the billions in revenue expected from President Trump’s sweeping tariffs. No longer destined for rebate checks, these funds will go straight intoreducing the national debt—a move that could recast America’s fiscal future. But that’s just one piece of an ambitious economic playbook that also embraces restructuring global trade, reviving domestic manufacturing, and redefining fiscal discipline.

A New Direction for Tariff Revenue

In an August 19 interview on CNBC, Secretary Bessent revealed expectations to substantially revise upward” earlier estimates of $300 billion in annual tariff revenue. His message was clear: this money won’t fund stimulus or dividends—but will be deployed to chip away at federal debt, paving the way for sustainable growth and potentially reversing decades of fiscal neglect

This emphasis aligns with broader fiscal goals. A recent Congressional Budget Office report projects that tariffs could reduce federal deficits by $4 trillion over the next decade—including $3.3 trillion from primary deficits and $700 billion from lower interest costs. Such figures largely offset the expected $4.1 trillion increase in debt from the “One Big Beautiful Bill” Act

From Protectionism to Production

Bessent underscores that tariffs are not an end in themselves, but a tool to revitalize the U.S. manufacturing base. He specifically highlighted sectors like medical supplies and shipbuilding, describing the tariffs as a “shrinking ice cube”: initially generating revenue, but ultimately replaced by domestic industrial resurgence and corresponding tax receipts

He illustrated this economic logic further—suggesting that a 20% tariff may only cause a modest 0.7% bump in consumer prices, based on MIT data. Meanwhile, domestic producers benefit, supporting job creation and domestic revenue growth

Smart Tariffs, Not Blanket Walls

Rejecting the notion of an impenetrable “tariff wall,” Bessent outlined plans for customized, reciprocal tariffs. These would be tailored by country based on their non-tariff barriers, currency manipulations, and industrial subsidies. A detailed rollout scheduled for April 2—dubbed “Liberation Day”—promised to reveal specific tariffs aligned to each nation’s trade practices .

This approach enables a calibrated response—raising tariffs against unfair trade while rewarding corrective policies, offering negotiating flexibility rather than a one-size-fits-all trade embargo.

The Universal Tariff Proposal: A Gradual Approach

In early 2025, leaked reports revealed that Bessent had proposed auniversal tariff starting at 2.5%, increasing by that same increment each month. This phased model allows businesses and trading partners to adapt, while retaining flexibility to scale up to ~20% if needed

His vision was not just about revenue—but stability, predictability, and giving stakeholders time to adjust to evolving global trade dynamics.

Despite public messaging that tariffs serve as a penalty to foreign exporters, Bessent candidly admitted that importers—and ultimately U.S. consumers—pay the tariffs at the dock. Yet, he framed this burden as manageable and temporary under the broader economic model: initial price increases offset by regulatory relief, energy cuts, and long-term investment in domestic production

He remained confident that key areas of the economy—housing, manufacturing, and consumer finance—could thrive under the combined strategy of tariffs and domestic reinvestment.

Global Strategy and the Mar‑a‑Lago Accord

Bessent’s tariff strategy is part of a wider economic realignment proposal dubbed the Mar‑a‑Lago Accord, developed with the Council of Economic Advisers. The plan envisions using tariffs, currency adjustments, and security-linked trade access to address global imbalances and restore U.S. industrial competitiveness—while ensuring the dollar retains its reserve status

Broader Reactions and Context

Economic Watchdogs: The CBO’s $4 trillion estimate provides strong validation for Bessent’s debt-first approach, though experts warn that tariff-driven growth may erode over time amid trade diversion and retaliation risks

Credit Markets: Agencies like S&P and Fitch see the tariff revenue as a stabilizing force for the U.S. debt outlook—yet they caution that underlying deficits remain steep and persistent

Wall Street View: Bessent’s approach—blending protectionism with measured negotiation—has been seen as a calming force amid trade anxiety and volatility

Why It Matters

Fiscal Discipline with a Twist: Prioritizing debt reduction is rare amid campaign-driven tariffs. Bessent’s approach reorients the strategy toward long-term stability—not just signal politics.

Industrial Policy Reimagined: Using tariffs to incentivize manufacturing, then gradually phasing out protectionism, could revive sectors left behind by globalization.

Negotiation Power Play: Custom reciprocal tariffs and the broader Mar‑a‑Lago framework give the U.S. stronger leverage, aligning trade carrots and sticks with national security priorities.

Conclusion

Treasury Secretary Bessent has unveiled a bold, multifaceted plan that views tariff revenue not as a short-term gift to consumers, but as a cornerstone of debt reduction, industrial revival, and global economic remodeling. From universal phased tariffs to personalized reciprocal frameworks, and from debt-first budgeting to coordinated global strategy—his plan marks a distinctly ambitious turn in the economic playbook.

Whether this approach delivers enduring fiscal health or flirts with protectionist backlash depends on execution—but the strategy is certainly engineered for high stakes.

News

New Colossus: The World’s Largest AI Datacenter Isn’t What It Seems

In a quiet corner of the American Midwest, a sprawling facility has been generating whispers among tech insiders, policy analysts,…

Kayleigh McEnany: This is Sending the World a Message

Kayleigh McEnany, former White House Press Secretary and political commentator, has long been recognized for her unflinching communication style and…

Candace Says Thiel, Musk, Altman NOT HUMAN

In a statement that has sparked widespread discussion across social media and news platforms, conservative commentator Candace Owens recently claimed…

Judge Pirro Reveals HARDEST Part of Job as US Attorney

Judge Jeanine Pirro is a household name in American media and law, known for her sharp wit, commanding presence, and…

Harris Faulkner: This Could Potentially EXPLODE

In the constantly shifting landscape of American media, few figures have sparked as much debate, admiration, and scrutiny as Harris…

Kaido is CRASHING OUT After Salish DUMPS Him For Ferran (Nobody Saw This Coming)

When word broke that Salish Matter had dumped Kaido and seemingly moved on with Ferran, the internet didn’t just react…

End of content

No more pages to load