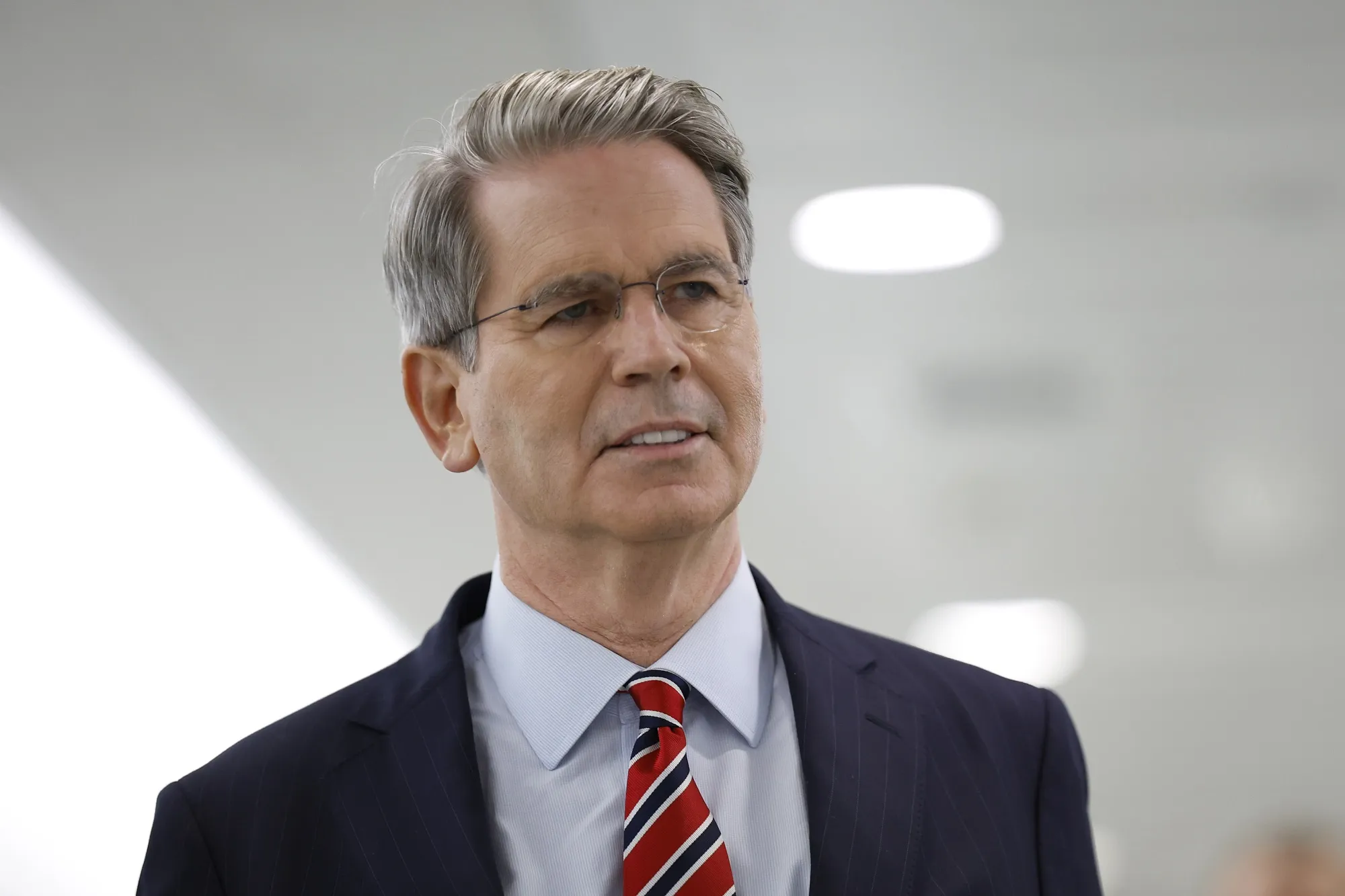

Scott Bessent, serving as U.S. Treasury Secretary under the Trump administration, has recently made a series of striking public statements about the trajectory of the United States’ federal deficit. Far from generic assurances, Bessent’s remarks reveal both alarming numbers and ambitious goals—and open up clashes with critics over political responsibility, fiscal realism, and economic growth strategy.

This article unpacks the “major news” Bessent has revealed about the U.S. deficit: his projections, the justifications he offers, where skeptics push back, and what this means for America’s financial future.

What Bessent Has Revealed: Key Claims & Projections

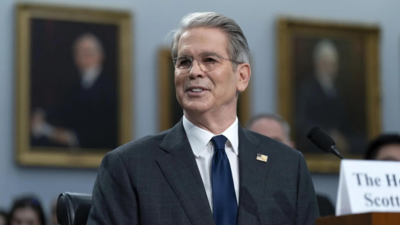

From his confirmation hearings to recent media interviews and congressional testimony, Bessent has dropped several consequential assertions about where the U.S. deficit currently stands—and where he aims to lead it.

Deficit as a Percentage of GDP — Near 6.5–6.7%

One of the most attention-grabbing claims is Bessent’s projection that the U.S. deficit will land between 6.5% and 6.7% of GDP for the current fiscal year. He framed this level of shortfall as a recurring phenomenon, not an aberration:

We are going to bring the deficit down slowly … this has been a long process.”

He also characterized the recent deficits as “blowouts in spending,” pointing to runaway discretionary and mandatory outlays that he views as the primary drivers.

These percentages are historically large in peacetime and outside of major crises or wartime — making them consequential in terms of market confidence, interest costs, and bond markets.

A Gradual Deficit Reduction Strategy

Bessent is careful not to claim an immediate “fix” or dramatic reversal. Instead, his public messaging emphasizes gradualism:

He told Face the Nation that “the deficit this year is going to be lower than the deficit last year, and in two years it will be lower again.”

He suggested targeting a reduction of roughly 100 basis points per year for four years to bring the deficit closer to more acceptable levels (for example, 3.5% of GDP).

He has resisted proposals to impose a radical trillion-dollar cut in one year, warning that such a shock would knock GDP growth.

In sum: Bessent’s revealed “major news” is that he sees the current deficit as excessive but not catastrophic yet; and he intends to chip it down gradually rather than through austerity.

We Don’t Have a Revenue Problem — We Have a Spending Problem”

At his Senate confirmation hearing, Bessent made a strong rhetorical statement:

We do not have a revenue problem in the United States of America. We have a spending problem … this spending is out of control.”

By framing the challenge this way, Bessent shifts the blame toward government expenditure, rather than calling for dramatic tax increases. The implication: controlling spending is the lever he expects to prioritize going forward.

Deficits, Debt Ceiling, and Non‑Default Assurance

As the U.S. moves closer to borrowing limits, Bessent has also made bold affirmations regarding default risk:

He has repeatedly insisted the U.S. will “never default” on its national debt, even as he acknowledges the trajectory of borrowing is pushing close to “the warning track.”

On Moody’s downgrade of the U.S. credit rating, he dismissed the move as a “lagging indicator,” suggesting it reflects past policies (especially under prior administrations) rather than the current trajectory.

Regarding the recently proposed “One Big Beautiful Bill” (Trump’s tax-and-spending package), he declined to definitively say whether it would increase the debt but noted that tariff revenues might offset some cost.

Altogether, these statements aim to reassure markets and investors that—even amid large deficits—the U.S. will not default or lose financial credibility.

Tariff Revenues as a Deficit Offset

Another notable move is Bessent’s optimistic forecasts about revenue from tariffs:

He has revised upward estimates of annual tariff collections, previously pegged around $300 billion, saying the number could be “substantially” higher.

He argues those increased funds will be used first to reduce debt, not for rebate checks or stimulus.

This plays into the broader narrative that alternative revenue sources (beyond traditional taxes) can help mitigate deficit pressures.

Reactions, Criticism & Skepticism

While Bessent’s revelations are bold, they invite pushback from analysts, economists, and think tanks. Below are key critiques and points of contention.

The Feasibility of Gradual Deficit Cuts

Critics argue that trimming a large fiscal gap (e.g., from ~6.5% to ~3.5%) over four years is politically and economically challenging. Some issues include:

Mandatory spending (Social Security, Medicare, Medicaid) and interest payments leave limited wiggle room for cuts.

Defense, infrastructure, and discretionary budgets are often politically protected, making deep cuts difficult to enact.

Economic growth assumptions may not come through to generate the increased revenues needed.

The Center for American Progress, for instance, estimated that if Bessent’s goal were taken seriously — reducing deficits to 3% by 2028 — it would demand massive cuts to anti-poverty programs or steep tax increases on the middle class.

Responsibility & Political Rhetoric

While Bessent blames overspending, especially by Democrats, for the budget gap, opponents counter that tax policy, growth projections, and leadership decisions all play roles. Others caution that using revenue from tariffs could be unstable or volatile, especially if trade policy or global markets shift.

Risk of Shocks & Recession

Even with gradualism, economies face volatility: interest rates, external shocks, recession risk, or unexpected obligations (e.g. to veterans, health crises) can blow out projections. Bessent himself has said there are “no guarantees” that a recession won’t hit

Credibility & Market Confidence

Large deficits sustained over time can erode investor confidence, raise interest rates, and crowd out private investment. While Bessent assures “no default,” persistent deficits raise questions about whether the U.S. can maintain favorable borrowing terms.

What It Means for the U.S. Economy & Policy

Given Bessent’s revelations, what are the practical implications moving forward?

Interest Costs Will Be a Major Drag

As the deficit remains large, interest payments on federal debt swell. These payments are non‑discretionary and soak up budget space — meaning less remains for priorities like infrastructure, education, or defense.

Tight Fiscal Discipline vs. Growth Tradeoffs

If spending is cut too aggressively, there’s risk of slowing economic growth. Bessent seems aware of this, preferring phased cuts and deregulation to spur private sector growth.

Political Battles Over Cuts & Taxes

With deficits elevated, every cut or revenue move becomes politically charged. Expect partisan fights over entitlement reforms, Medicaid adjustments (which Bessent has hinted at), tax policy expansions, or reliance on tariffs.

Debt Ceiling Deadlines & Market Volatility

The proximity to debt limit thresholds makes any failure to raise or suspend it a flashpoint. Bessent’s assurances notwithstanding, the margin for error is narrowing, and markets will react sharply to headlines or political stalemate.

Reliance on Growth & “Dynamic Scoring”

Bessent and his team appear to lean on optimistic growth assumptions (e.g., 3% or better) to help bridge the gap between revenue and spending. But if growth underperforms, the gap will widen, forcing recalibration.

Conclusion

Scott Bessent’s public pronouncements reveal a candid and ambitious strategy: he acknowledges a near-historic deficit burden (projected at 6.5–6.7% of GDP), yet pledges a multi‑year, gradual reduction path. He frames the core problem as overspending, and uses rhetoric and forecasts to reassure markets that default is off the table.

News

New Colossus: The World’s Largest AI Datacenter Isn’t What It Seems

In a quiet corner of the American Midwest, a sprawling facility has been generating whispers among tech insiders, policy analysts,…

Kayleigh McEnany: This is Sending the World a Message

Kayleigh McEnany, former White House Press Secretary and political commentator, has long been recognized for her unflinching communication style and…

Candace Says Thiel, Musk, Altman NOT HUMAN

In a statement that has sparked widespread discussion across social media and news platforms, conservative commentator Candace Owens recently claimed…

Judge Pirro Reveals HARDEST Part of Job as US Attorney

Judge Jeanine Pirro is a household name in American media and law, known for her sharp wit, commanding presence, and…

Harris Faulkner: This Could Potentially EXPLODE

In the constantly shifting landscape of American media, few figures have sparked as much debate, admiration, and scrutiny as Harris…

Kaido is CRASHING OUT After Salish DUMPS Him For Ferran (Nobody Saw This Coming)

When word broke that Salish Matter had dumped Kaido and seemingly moved on with Ferran, the internet didn’t just react…

End of content

No more pages to load