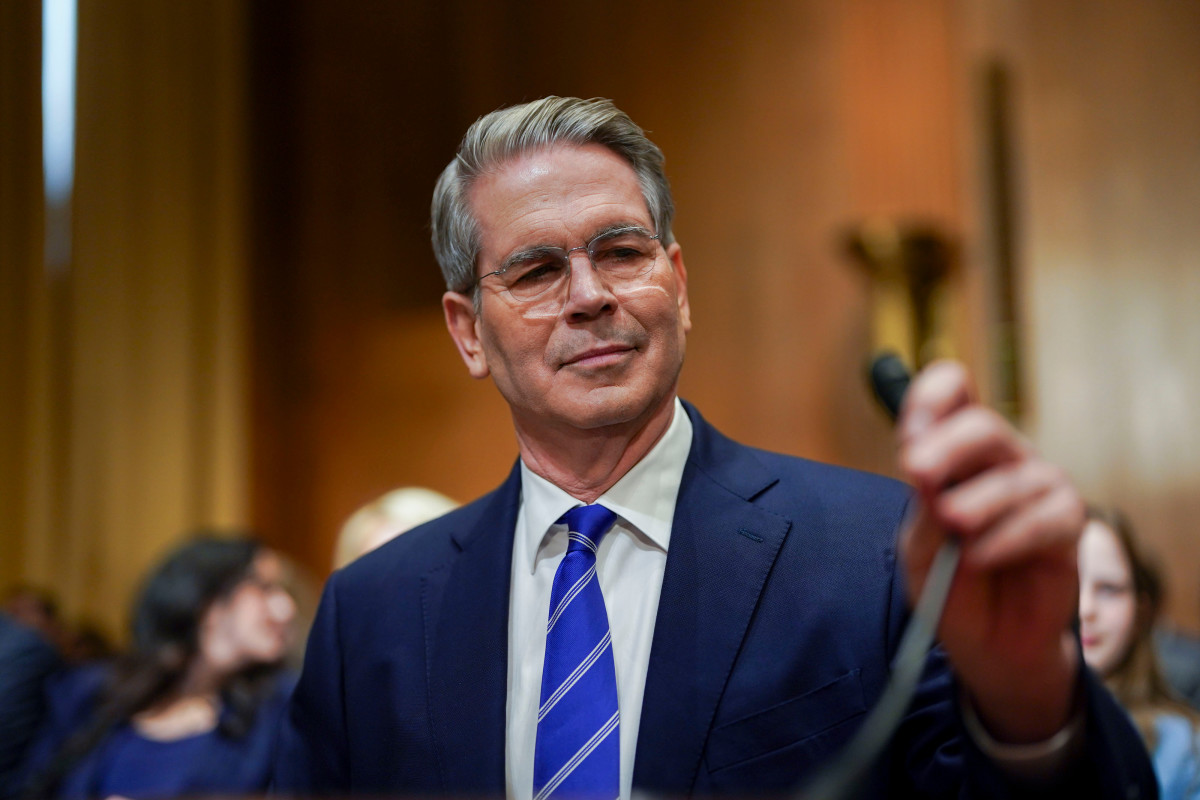

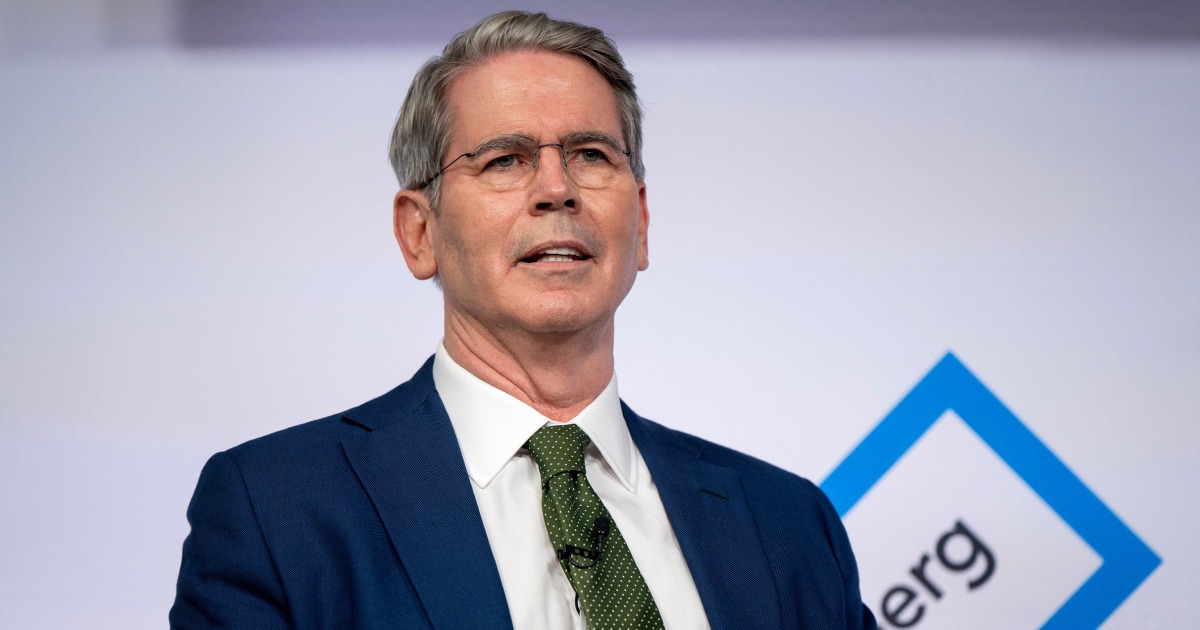

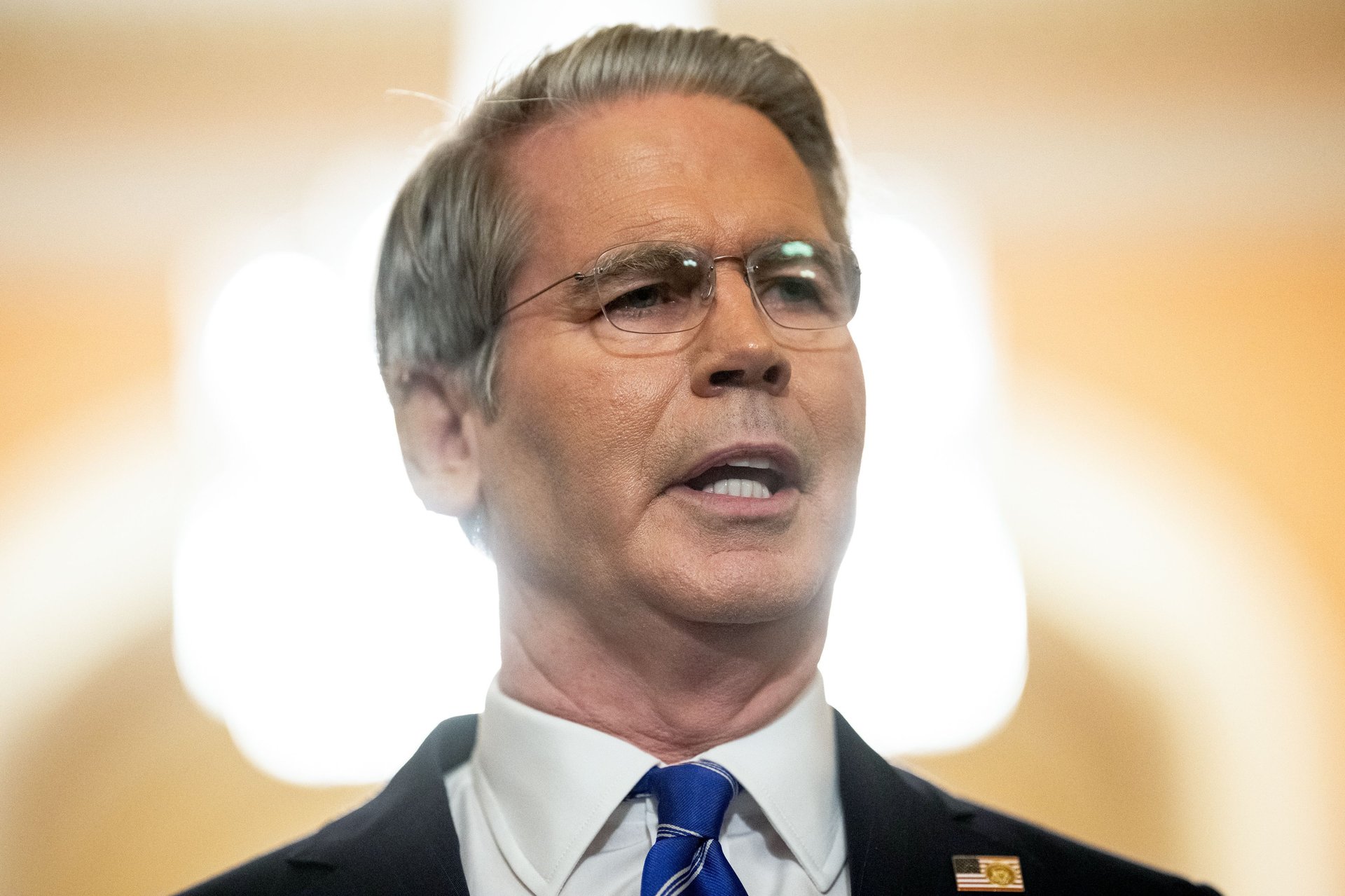

Treasury Secretary Scott Bessent recently appeared on CNBC’s Squawk Box in an in‑depth interview, touching on trade policy, the economy, and U.S. relations with China, among other topics. The interview is not just a simple Q&A; it reveals current priorities of the Treasury Department under the Trump administration, key economic challenges, and strategic positioning on both domestic and international fronts. This essay investigates what Bessent said, what is implied by his words, what issues loom large, and what could follow.

Key Topics from the Interview

From the CNBC interview, several main topics stand out:

Trade Relations & Tariffs

Bessent discussed the state of trade negotiations with China, emphasizing the U.S. desire for more balanced, reciprocal trade. He made clear that the administration sees past trade arrangements as unjust—where the U.S. accepts large deficits, asymmetric regulatory burdens, non‑tariff barriers, and what the administration considers unfair subsidies.

He also spoke about how future trade deals are being structured. He pointed out that the U.S. expects trading partners to do more, both in opening access to markets and adjusting economic policies that disadvantage the U.S. (e.g., currency manipulation).

Strong Dollar Policy

A major emphasis in the interview was that there is no intention to abandon or weaken the U.S. strong‑dollar policy. Despite pressures, Bessent affirmed that maintaining the dollar’s strength globally is essential.

He noted that while the U.S. wants to prevent other countries from weakening their currencies (bilateral currency manipulation), the idea is not to make the U.S. dollar weak as a strategy for competitiveness.

Economic Competitiveness, Regulation, & Tax Policy

Bessent discussed regulatory reform and deregulation as priorities. The aim is to make the U.S. more attractive to investment, both domestic and foreign.

He also touched on tax certainty: having stable, predictable tax policies so businesses can plan ahead.

U.S.‑China & Global Relations

On diplomatic/trade fronts, he raised expectations over dealing with China, especially on issues such as tariffs, economic frameworks, and how the U.S. expects actions from Beijing.

He spoke of ongoing deals and negotiations, including those around TikTok, purchases, investment flows, and strategic supply chains like rare earths.

Market Volatility vs. Long‑Term Outcomes

A recurring theme is that the administration is willing to accept “short‑term volatility” in markets if the policies lead to stronger long‑term foundations

He expressed less concern with daily or weekly fluctuations, focusing instead on the broader arc of competitiveness, growth, and fiscal responsibility.

Implications of Bessent’s Statements

The interview is valuable not just for what was said, but for what it implies.

Shift Towards More Assertive Trade Policy

Bessent’s repeated references to reciprocity, currency manipulation, and non‑tariff barriers suggest that the U.S. is moving away from passive trade negotiation and toward a more proactive stance. This could mean more tariffs or trade barriers if partners don’t respond, not simply lighter diplomacy.

Strong Dollar as Anchor

The strong‑dollar policy assumption is crucial. Even as the U.S. seeks trade advantage, it appears to be committed to maintaining strength in the currency, which has several effects:

It limits inflationary pressures from imports.

But it also can make U.S. exports more expensive. So Bessent’s other tools—trade barriers, opening foreign markets, foreign investment—are critical to offset that.

Regulation, Tax & Investment Focused On Long Run

The talk of regulatory rollback, clearer tax policies, and investment signals that the administration believes that economic competitiveness hinges not just on trade, but on making the business climate attractive. It also means that short‑term political costs (e.g. from tariffs, from discontent over trade frictions) might be accepted in service of these bigger goals.

Risk of Backlash: Trade Wars, Supply Chain Disruption & Costs to Consumers

A more aggressive trade posture can provoke retaliation. Bessent’s acknowledgment of market volatility and cost implications suggests he is aware of risks. But the trade‑offs are large: costs to industry, higher prices, or supply chain dislocations may result. The public impact (consumer prices, wages) may become a political issue.\

Global Diplomacy & Strategic Competition

The U.S. seems to be positioning itself not just as reactive to trade rivals but as shaping global norms: how supply chains work, how trade is regulated, what counts as fair competition. China figures centrally here, but European behavior is also under scrutiny. The administration seems to be saying: U.S. strength and credibility demand more from allies and competitors alike to conform to what it sees as mutually fair standards.

:max_bytes(150000):strip_icc()/GettyImages-2161768439-412574fe432d484eb211d6b599013ab7.jpg)

Key Challenges and Questions

Even with ambitious goals, many uncertainties remain.

Enforcement and Reciprocity: How will the U.S. ensure that trading partners follow through? If countries resist changing subsidies, currency practices, or regulatory regimes, will tariffs or other sanctions follow? What legal or international trade frameworks will or can be used?

Balancing Inflation, Consumer Costs, and Domestic Politics: Trade barriers can raise costs on goods, especially when supply chains are interlinked. Even if the administration downplays short‑term volatility, consumers often feel price pressures immediately. This could lead to political pushback.

Coordination with Allies: Policies aimed at China, for example, may require cooperation with EU nations or others. But those allies may have different priorities (e.g. industrial policy, environmental standards, supply chain resilience). Aligning strategies or managing divergence will be complicated.

Dollar Strength vs Export Competitiveness: While a strong dollar helps in some respects, it can hurt American exporters and make U.S. goods more expensive abroad. The administration’s tools must offset this tension, or risk harming one side while strengthening another.

Economic Growth vs Deficit / Debt Pressures: Long‑term growth requires investment, but trade deficits, federal debt, and fiscal pressures remain. If tariff revenues are used to pay down debt (as some statements imply), that could help. But debt dynamics, interest rates, and spending tradeoffs remain large.

What to Watch Going Forward

To assess how things will unfold, there are several indicators and developments to monitor:

Trade Negotiation Outcomes: Will there be concrete agreements from China or other countries on terms of trade, currency behavior, subsidies? How enforceable will they be?

Tariff Adjustments / Retaliations: Whether the U.S. imposes new tariffs, extends existing ones, or removes them—and how trading partners respond—will be critical for assessing risk to supply chains and costs.

Regulatory / Tax Policy Moves: Legislation or executive actions that reduce regulatory burdens, or that provide tax certainty (such as making tax provisions permanent), will show whether the rhetoric corresponds with action.

Macroeconomic Indicators: Inflation, import/export balances, currency movements, consumer price indices—these will show whether trade policies are causing unintended consequences. Also growth in investment, both foreign and domestic, which is central to the administration’s competitiveness goals.

Public Sentiment and Political Responses: If consumers begin to feel price hikes, or if sectors (e.g. agriculture, manufacturing) get harmed, there will likely be political pressure. How Congress reacts, how economic commentators respond, and how the media frames trade disruptions will matter.

Global Responses: How China, the EU, India, and others react—politically, economically—will influence the success of the U.S. strategy. For instance, whether they adjust their policies, negotiate in good faith, or counteract U.S. moves with their own trade barriers.

Broader Significance

The interview with Scott Bessent is telling within the larger story of U.S. economic strategy in 2025, reflecting several broader dynamics:

Competition with China and Geoeconomics: The U.S. increasingly frames economic policy in geopolitical terms—not just trade for prosperity, but trade as part of strategic competition: who controls supply chains, who sets rules.

Populist Pressures & Economic Nationalism: Domestic political forces favor policies that protect American workers, manufacturing, and sovereignty. This puts pressure on administrations to adopt sharper, tougher trade measures, even at risk of short‑term economic friction.

Redefinition of Global Economic Rules: The U.S. seems to be pushing for rules not just in trade but in what counts as fairness—currency behavior, regulation, state subsidies, industrial policy. These are things traditionally handled with international negotiations but may now be more contested.

Balancing Markets and Stability: The talk of accepting volatility indicates a shift: growth and market performance alone are not sufficient. Stability, fairness, investment, resilience are being elevated in priority.

Critique & Risks of Overpromising

While many of the goals Bessent lays out are ambitious and some may be appealing, there is risk in underdelivering or mismanaging expectations.

Ambiguity in Metrics: What exactly counts as “balanced trade,” “reciprocity,” or “fair behavior” can be subjective. Without clear metrics, promises may seem vague or even misleading.

Implementation Difficulties: International trade negotiations are complex; achieving change in subsidy practices, currency manipulation, supply chain rules often takes years and involves many stakeholders.

Political Costs: Tariffs often hurt certain industries more than others, and those costs are borne by consumers, especially when goods become more expensive. The benefits of trade adjustment may take time to show, but costs may be immediate.

Retaliation Risk: Countries may respond in kind—tariffs on U.S. exports, restrictions, or other countermeasures—that can hurt U.S. companies or farmers.

Unintended Consequences: Trade disruption, supply chain shifts, inflation, and lessened international cooperation in other domains (climate, diplomacy, security) could follow if adversarial stances escalate.

Conclusion

The CNBC interview with Treasury Secretary Scott Bessent offers a valuable window into the current U.S. government’s economic strategy. It underlines an assertive trade policy, a steadfast commitment to a strong dollar, and a broader goal of improving competitiveness through regulatory reform and investment. At the same time, it acknowledges market volatility, costs, and the need to manage relationships with allies and adversaries alike.

Ultimately, what makes Bessent’s message consequential is not just what he said, but how the policies and politics align. If the administration can deliver on trade agreements, maintain investor confidence, and mitigate the short‑term pains of protectionism while boosting long‑term growth, his vision could mark a pivot in U.S. economic foreign policy. But if not, there’s a risk of disappointment, backlash, and economic stress for sectors and consumers.

Going forward, watching concrete actions—tariff rulings, regulatory rollbacks, trade frameworks—and their effects on prices, jobs, and trade flows will reveal whether this interview is a preview of real transformation, or mainly a signaling exercise.

News

New Colossus: The World’s Largest AI Datacenter Isn’t What It Seems

In a quiet corner of the American Midwest, a sprawling facility has been generating whispers among tech insiders, policy analysts,…

Kayleigh McEnany: This is Sending the World a Message

Kayleigh McEnany, former White House Press Secretary and political commentator, has long been recognized for her unflinching communication style and…

Candace Says Thiel, Musk, Altman NOT HUMAN

In a statement that has sparked widespread discussion across social media and news platforms, conservative commentator Candace Owens recently claimed…

Judge Pirro Reveals HARDEST Part of Job as US Attorney

Judge Jeanine Pirro is a household name in American media and law, known for her sharp wit, commanding presence, and…

Harris Faulkner: This Could Potentially EXPLODE

In the constantly shifting landscape of American media, few figures have sparked as much debate, admiration, and scrutiny as Harris…

Kaido is CRASHING OUT After Salish DUMPS Him For Ferran (Nobody Saw This Coming)

When word broke that Salish Matter had dumped Kaido and seemingly moved on with Ferran, the internet didn’t just react…

End of content

No more pages to load